Taiwanese giant TSMC is the leader of the global semiconductor industry, and the first month of the third quarter turned out to be quite successful for the company, even by its own high standards. Revenue in July soared by 26% year-on-year, reaching $10.8 billion. As before, this growth is driven solely by the high demand for components for artificial intelligence systems manufactured by TSMC at the request of key customers.

The total revenue for the year’s first seven months shows an increase of 38%. This positive trend persists despite the strengthening of the Taiwanese dollar, which traditionally puts pressure on export-oriented companies and Dow futures performance. This factor makes TSMC products much more expensive for foreign buyers. Given that the majority of the company’s advanced production facilities are concentrated in Taiwan, the exchange rate of the national currency has a direct and significant impact on the expenses of overseas clients.

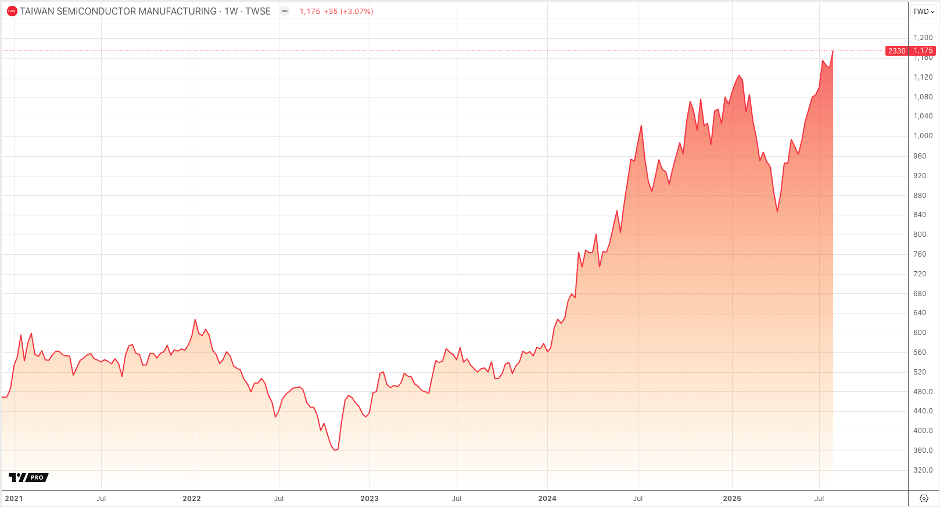

TSMC’s stock price has reached a new all-time high, which was a direct result of US President Donald Trump’s statements about the company’s exemption from increased customs duties. The reason was TSMC’s active investments in the localization of chip production in the United States.

In addition, smartphone components continue to form a significant share of TSMC’s revenue. Recent statements by Sony and Apple about the recovery in demand in this market add confidence in maintaining the current positive dynamics of the Taiwanese giant’s strong financial results.

The uncertainty of the Trump administration’s trade policy remains the main threat to all major players. Thus, Taiwan has found itself vulnerable due to its large trade deficit and the US president’s strict requirements for trading partners.

Trump is ready to consider reducing customs duties on goods from Taiwan, but only if two extravagant conditions are met:

- TSMC’s purchase of a 49% stake in the American semiconductor giant Intel.

- Additional investments in the US economy in the amount of $400 billion.

If these requirements are unmet, imports of Taiwanese goods to the United States will be taxed at a rate of 20%. For comparison, Japan and South Korea have already received a 15% rate, but at the cost of promises to invest considerable sums in American industry.

The demand for an additional $400 billion in investments in the United States looks especially ambitious considering TSMC’s existing commitments. Even before January of this year, the company planned to spend $65 billion to build three advanced factories in Arizona over several years. Trump tightened the conditions by raising the amount to $165 billion and increasing the number of facilities to five, including two chip testing and packaging centers, to eliminate the need to transport silicon wafers back to Taiwan.

Adding another $400 billion to these obligations is a serious requirement. It is difficult to imagine that a public company with global shareholders would agree to such a step solely for the “good of the entire island”, especially considering that the Taiwanese authorities own only 6.38% of TSMC shares and cannot formally dictate its strategy.

The condition for buying 49% of Intel looks even more complex. However, for a distressed American manufacturer, the appearance of such an investor could be a lifeline. The deal has many obstacles, from regulatory barriers to strategic contradictions. By the way, rumors about the transfer of American Intel plants to TSMC have already been circulating for the last half-year, forcing the leadership of the Taiwanese company to refute such scenarios publicly.

The main dilemma for TSMC in Trump’s hypothetical scenario is to impose an excessive burden: the company must actually decide the fate of the entire Taiwanese economy. The question is whether its management is ready to radically revise its business principles and global strategy under the pressure of these circumstances.