Neteller is an e-wallet operated and run by Paysafe Group. It has over 23 million users worldwide and it offers all the services and features that most other e-wallets do. Users can send and receive funds using Neteller, as well as use it to store value online.

In this article, we’ll go in-depth with all the pros and cons of using Neteller, as well as how it compares to most. As is the case with most e-wallets, Neteller is well-suited to some users and it can be used for both professional and personal purposes.

What’s Neteller?

Neteller is an e-wallet used to transfer money online. It was founded in 1999 and it’s therefore one of the oldest in the market. It was a product of the Paysafe Group and the whole company was acquired by Skrill in 2015.

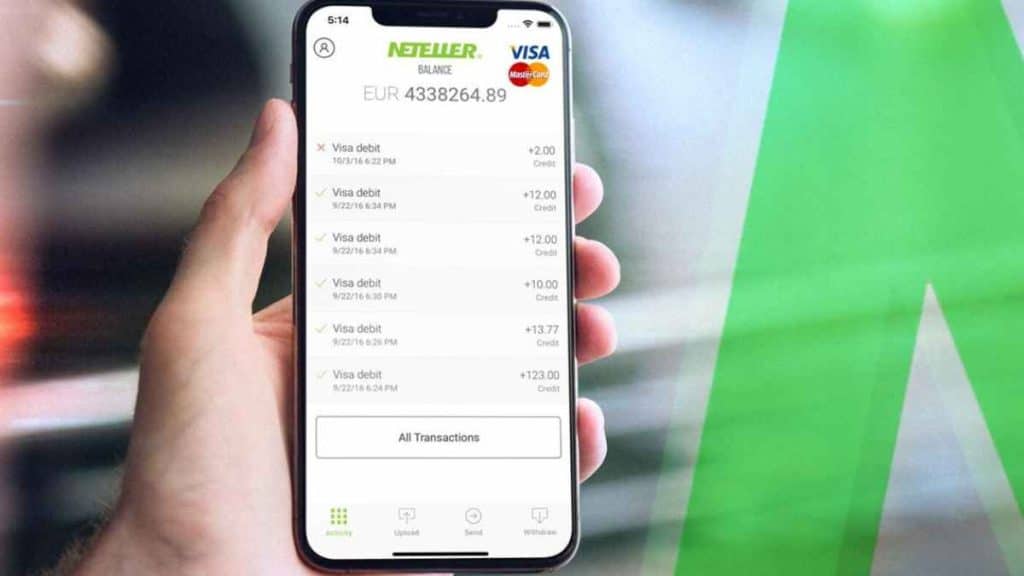

In the year 2000, Neteller focused intensely on offering its services to betting establishments and a lot of Neteller casinos emerged. These establishments offer all the services of online betting sites and use Neteller as their main payment method. Neteller also offers an app version of its main service, featuring all the same services.

Pros of Using Neteller

There are many benefits of using Neteller, mostly stemming from its wide network of users and a variety of features.

Safety

Neteller is safe to use and it’s easy enough to keep track of transfers in case something goes wrong. The payments are usually made right away regardless of the amount, the region, or the currency you’re using.

Personal data that a user needs to provide in order to use Neteller is also kept safe and isn’t shared with any third parties. For the most part, that information includes a card number, an email, and your legal name. All of the personal information is safely guarded thanks to high data protection systems.

Instant Transfers

Transfers made with Neteller are instantaneous. That’s one of its better features since you get to withdraw and deposit funds within a few seconds. Most other payment methods have different waiting periods depending on the amount you’re transferring.

Depositing funds from Neteller to a bank or card may take a bit longer since it depends on the policy set up by the bank or card you’re using. In most cases, the funds will be available on your card or bank within a few days. Neteller also issues its own virtual card and there are no waiting periods when depositing on it.

Prepaid Mastercard virtual cards

Neteller issues its own virtual card in cooperation with Mastercard. This card can be used to make payments and withdraw funds. There are no fees or expenses for issuing the card since it’s a virtual one and a part of the promotional offer created by Mastercard and Neteller.

Virtual cards can’t be used to withdraw cash from an ATM, but they can be used to make payments at POS terminals. Every transaction is charged with a fee of $2.5 regardless of the amount you’re transferring.

Free Payments at Merchant Sites

Neteller has a longstanding program of teaming up with merchants that use their services as a preferred payment method. There are no fees for customers paying with Neteller at Neteller merchant’s online shops. It’s one of the most popular convinces the services have to offer, especially for those who make frequent online payments.

The merchants can accept payments in 30 different currencies and a merchant account is free to set up. The option is open to almost all industries that work within the legal limits set in the country the merchant is operating.

Widely Accepted For Betting

Betting establishments often use Neteller as one of their payment options and sometimes as a preferred one. It’s well suited for payments at gambling sites since there are no large fees and it works fast. Neteller also allows for small payments, which is a good choice for betting as well.

It made its reputation with betting establishments in particular during the early 2000s and many such establishments have a relationship with Neteller allowing its users to pay smaller fees or in some cases to get extra bonuses.

Cons

There are also downsides to using Neteller. It’s not suited to every user and every type of transfer. Users should carefully weigh the negatives against the benefits and assess the ways they plan to use the services before making the choice to commit to them.

Currency Conversion Rates

Neteller allows users to pay in many different currencies but it has its own conversion rate, somewhat higher than that you would get in a bank. The rate is quite steep and in fact, it’s actually a fee for using a foreign currency. The fee is set at 3.99 percent regardless of the amount.

VIP users that pay an additional subscription fee, also get a lower conversion rate, set at 1.5 percent.

Slow Customer Support

Customer support offered by Neteller isn’t as good as most users would expect it to be. Customer support is a key feature for an e-wallet since the user wants to be able to react to the service as soon as there’s an issue.

Neteller can be reached via a variety of different channels, and it is staffed by experts. However, it’s pretty slow and it can sometimes take days until the issue you’ve raised is resolved. This can be a deal breaker for some users, but if you’re in no hurry the customer support will work eventually.

Not All Services Are Available Worldwide

Neteller offers its services in most of the world but not all features are available. That’s because Neteller is limited by the laws, rules, and regulations of the countries it operates. One of the most used features – a virtual card is only available in EEA countries.

There are 30 EEA countries – 27 members of the EU, Norway, Lichtenstein, and the UK. US users of Neteller can’t use a virtual card due to the complex regulations governing its use. This was the case for most other e-wallets that offer a similar service, and only a few have found a way around it.

What Cards Can Be Used With Neteller?

Neteller works with a lot of different cards and payment services.

For your first deposit, you can make a local bank deposit or an international bank transfer, use payment cards (MasterCard Credit, MasterCard Debit, VISA Debit, VISA Credit, VISA Electron, Maestro), e-wallets (PaysafeCard, Skrill), fast bank transfer, PaysafeCash, Bitcoin, or Bitcoin Cash. After verifying your account, deposit methods open up, including Trustly, Boku, GiroPay, iDeal, and others.

Eight different currencies are supported: GBP, USD, EUR, JPY, AUD, DKK, CAD, and SEK.

To Sum Up

Neteller is one of the oldest online e-wallets still in use. It was founded in 1999 and now it’s a part of Skrill. It’s especially well-suited to the needs of online merchants and online betters. Neteller is available as a website or an app and it issues its own virtual cards, with lower fees. The service is available all over the world, but not all of its features are.

The fees for using foreign currencies are somewhat high and Neteller doesn’t have the best customer support out there. It will probably take you a few days to resolve an issue after you’ve contacted the support.