For two decades, Nvidia has remained synonymous with the gaming and professional graphics adapter market. However, it was the bet on the CUDA architecture that turned the company into a full-fledged leader in parallel computing, and not just an industry driver, ultimately determining its current dominance. Following the Q2 results, Nvidia strengthened its position in the consumer segment by another 2%. Now the company’s share in the discrete graphics card segment has grown sequentially from 92% to 94%.

Nvidia’s growth naturally occurred at the expense of its main competitor, AMD, whose share decreased from 8% to 6% in the quarter. Surprisingly, Intel is still present in this market. However, most investors have long understood that it participates only nominally, maintaining visibility mainly through integrated graphics. Intel remains the leader in the desktop segment primarily due to the widespread use of integrated GPUs.

Overall, the market situation in the second quarter was quite atypical. Observers noted that the prices of entry-level and mid-range graphics cards decreased, while prices for top models continued to rise, and demand consistently exceeded supply. In addition, the increase in import duties in the United States put additional pressure on the market. This also influenced EUR/USD dynamics, as fluctuations in the exchange rate affected the cost of imported components and pricing strategies for European consumers. Fearing further price increases, consumers significantly increased their purchases, providing a short-term sales surge.

The dynamics in the related segments also proved to be mixed. Sales of desktop processors decreased by 4.4% year-on-year, but increased by 21.6% sequentially. The number of PCs sold increased from 18 to 22 million units, corresponding to a quarterly growth. Against this background, shipments of discrete graphics cards increased by almost 30%, reaching 11.7 million units. For comparison, over the past ten years, the average increase in the transition from the first to the second quarter was only 5.7%. In the server segment, graphics accelerators showed a 4.7% shipment increase.

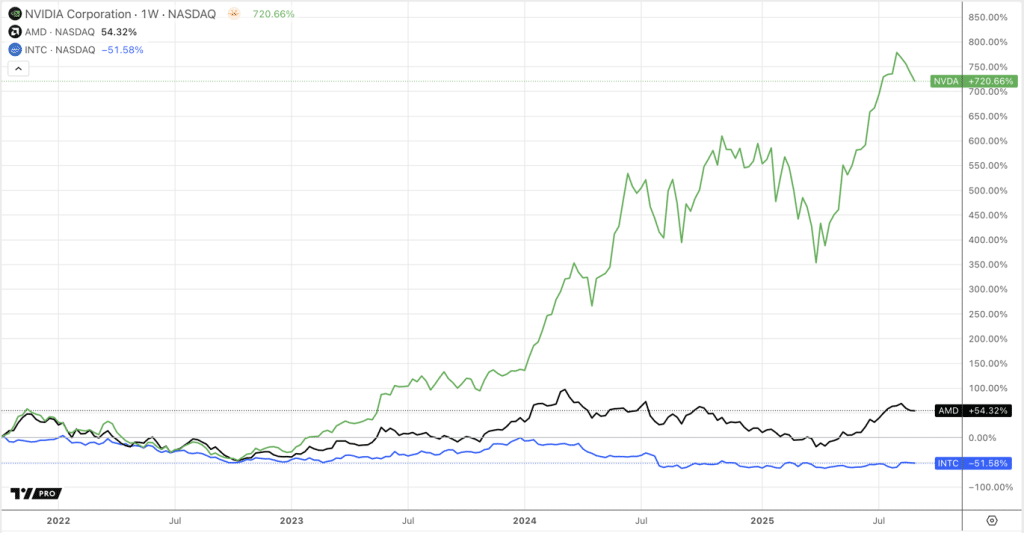

Overall, the dynamics of leading manufacturers’ shares reflect the market structure. Nvidia’s stock price continues to show steady growth, which is explained not only by its record share in the graphics card market, but also by the demand for accelerators for artificial intelligence. Nvidia has consistently been among the top stock gainers in recent sessions, setting the pace for other technology companies. The company’s participation in the list of the largest issuers by capitalization makes it one of the key components of the largest technology indexes, where Nvidia effectively sets the tone for the entire segment.

Against this background, AMD shares remain posting gains, although they do not show comparable dynamics. However, the declining share in the consumer segment and high competition from Nvidia are holding back the company’s capitalization growth, which is reflected in a smaller contribution to the market structure. The drop in market share to 6% increases the pressure on quotes, as investors are already beginning to price in the risks of AMD’s further retreat in the discrete graphics segment.

By 2028, shipments of discrete graphics cards are expected to decrease by an average of 5.4% annually. In other words, by the end of this period, about 163 million devices will be operational worldwide, with desktop PC penetration reaching 87%. At the same time, Nvidia’s influence will likely continue in the coming years, as the company combines leadership in the mass segment with dominance in high-performance computing.