Portfolio management is a crucial aspect of investment risk management and asset management. This comprehensive guide will explore portfolio management fundamentals, their significance, and the key principles involved. Whether you are a seasoned investor or just starting your investment journey, understanding portfolio management will empower you to make informed decisions and achieve your financial goals. We will see Amol Sahasrabudhe’s sayings on this.

Definition and Objectives of Portfolio Management

Portfolio management refers to the process of managing a collection of investments, known as a portfolio, with the aim of achieving specific financial objectives. The primary objectives of portfolio management include capital preservation, capital growth, income generation, and risk mitigation. By effectively managing a portfolio, investors can optimize returns while considering their risk tolerance and investment goals.

Asset Allocation Strategies

Diversification: The Foundation of Portfolio Management

Diversification is a fundamental principle of portfolio management. It spreads investments across asset classes, geographical regions, sectors, and investment styles. By diversifying, investors can reduce the impact of individual investment risks and enhance the overall risk-adjusted returns of the portfolio.

Risk and Return Considerations in Asset Allocation

Investors must assess the tradeoff between risk and return when determining asset allocation. Modern Portfolio Theory (MPT) and the concept of the efficient frontier help investors understand the optimal asset allocation that maximizes returns for a given level of risk. Risk tolerance, time horizon, investment objectives, and market conditions influence asset allocation decisions.

Strategic vs. Tactical Asset Allocation

Strategic asset allocation involves establishing a long-term investment strategy based on an investor’s risk profile and objectives. On the other hand, tactical asset allocation involves making short-term adjustments to take advantage of market opportunities or respond to changing economic conditions. Balancing long-term goals with short-term tactical decisions is crucial for successful portfolio management.

Portfolio Construction Techniques

Building Blocks of Portfolio Construction

Constructing a portfolio involves selecting appropriate asset classes that align with investment objectives. It also entails security selection, where investors analyze individual securities using fundamental or technical analysis. Determining each investment’s position size and portfolio weights is essential to achieve diversification and optimize returns.

Active vs. Passive Portfolio Management

Active portfolio management involves active trading and seeks to outperform the market. It relies on investment strategies, research, and market analysis to identify mispriced securities. Passive portfolio management, on the other hand, aims to replicate the performance of a specific market index through index funds or exchange-traded funds (ETFs). Combining active and passive approaches can offer a blended approach to portfolio management.

Monitoring and Rebalancing

Regular portfolio monitoring is crucial to ensure it stays aligned with investment objectives. Monitoring involves tracking investment performance, reviewing market conditions, and assessing individual securities. Rebalancing the portfolio periodically helps maintain the desired asset allocation and adjust for changing market dynamics.

Risk Management in Portfolio Construction

Identifying and Assessing Risk

Identifying and assessing risk is an integral part of portfolio management. Common types of investment risk include market, credit, liquidity, and operational risks. Investors use various metrics such as volatility, beta, and value at risk to quantify risk levels.

Risk Management Techniques

Diversification is a key risk management tool that helps mitigate specific risks associated with individual investments. Hedging strategies, including options, futures, and derivatives, can provide additional protection against adverse market movements. Risk-adjusted performance measures, such as the Sharpe ratio and Jensen’s alpha, help evaluate a portfolio’s performance in relation to the risk taken.

Performance Evaluation and Reporting

Evaluating Portfolio Performance

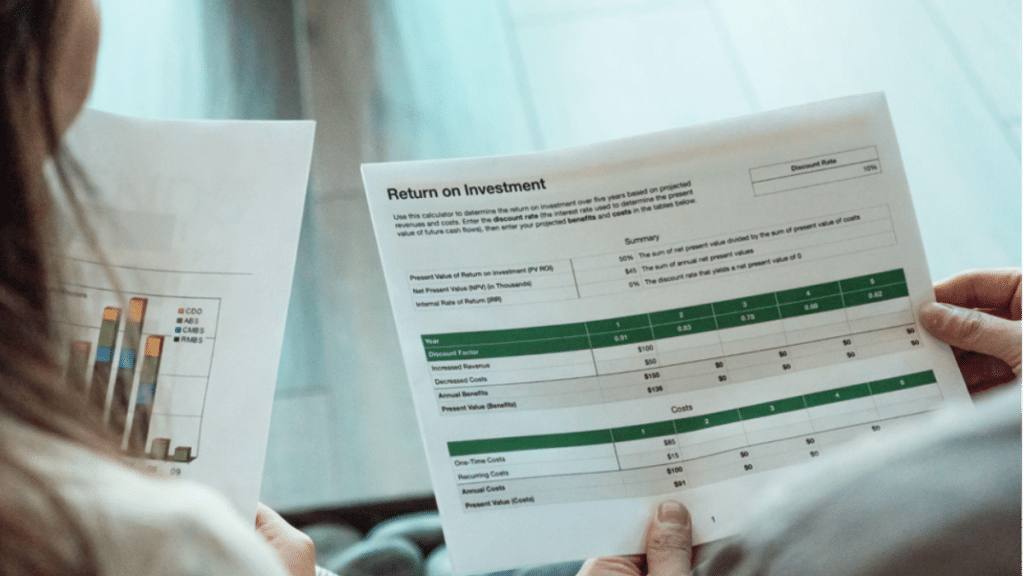

Benchmarking is essential for evaluating portfolio performance. It involves comparing the portfolio’s returns against a relevant benchmark, such as a market index or a peer group. Performance measurement metrics, including return on investment (ROI), risk-adjusted returns, and standard deviation, provide valuable insights into portfolio performance.

Client Reporting and Communication

Transparent and effective client reporting is crucial for building trust and maintaining strong investor relationships. Successful client reporting includes clear and concise performance summaries, detailed asset allocation breakdowns, and regular communication to address client concerns and provide updates on portfolio performance.

Advanced Portfolio Management Concepts

Alternative Investments and Portfolio Diversification

Including alternative investments in a portfolio, such as real estate, private equity, or commodities, can enhance diversification and potentially improve risk-adjusted returns. Understanding the characteristics and risks associated with alternative investments is vital for practical portfolio construction.

Behavioral Finance: Understanding Investor Psychology

Behavioral finance explores how investor psychology and emotions can influence investment decision-making. Recognizing common biases and cognitive errors can help investors avoid costly mistakes and make rational investment choices.

Environmental, Social, and Governance (ESG) Considerations

ESG factors have gained significant importance in portfolio management. Integrating environmental, social, and governance criteria into investment decisions can contribute to sustainable and responsible investing while considering long-term risks and opportunities.

Incorporating Technology in Portfolio Management

Technology is crucial in portfolio management, enabling efficient data analysis, risk modeling, and trade execution. Embracing technological advancements, such as artificial intelligence and machine learning, can enhance portfolio construction and decision-making processes.

Conclusion

In summary, portfolio management is a multifaceted discipline that requires careful consideration of asset allocation, diversification, risk management, and performance evaluation. By understanding the basics of portfolio management, investors can build well-structured portfolios tailored to their objectives and risk tolerance. Amol Sahasrabudhe’s expertise and experience in portfolio construction and risk management further exemplify the significance of these principles in achieving investment success.

By adopting the fundamental principles and strategies outlined in this guide, investors can confidently navigate the complexities of portfolio management, optimize risk-adjusted returns, and work towards their financial goals. Remember, successful portfolio management is a continuous process that requires ongoing monitoring, analysis, and adjustments to adapt to changing market conditions and investor needs.