Investor optimism surged again following news of major investments and partnerships in the booming AI sector. The capitalization of leading chip manufacturers increased by $200 billion in a single trading session. The rally was fueled by OpenAI’s $500 billion valuation, new memory supply deals with Samsung and SK Hynix, and rumours about a potential AMD-Intel partnership.

These events have already lifted shares of TSMC, Foxconn, and other market players, boosting their performance and reflecting the global influence of the AI boom. It traditionally affects even Chinese stock indexes – the Hang Seng index has grown by more than 30% since the beginning of the year.

In general, as part of a global trend, the correlation between technology giants and S&P 500 and Nasdaq futures is noticeably increasing amid recent developments in the AI industry. For example, Microsoft, which is actively developing its own data centers and AI chips, directly affects the dynamics, especially when news breaks about product launches or delays. Any shift in timing – as seen with the launch of the Braga AI chip – is instantly reflected on the exchanges, emphasizing how tightly tech giants are linked to market sentiment.

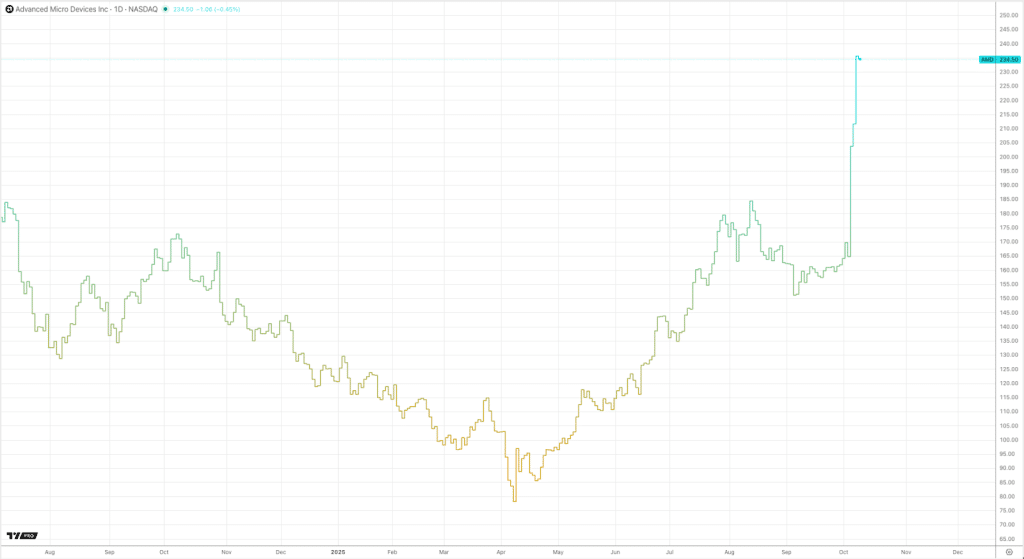

AMD has reportedly signed an agreement with OpenAI, granting it the right to purchase up to 10% of its shares and securing the supply of Instinct GPUs with a total capacity of 6 GW. An initial 1 GW supply is planned for the second half of 2026, with subsequent tranches as the OpenAI infrastructure scales. As expected, AMD shares have already risen in price by 40% and the company’s capitalization has reached $380 billion. According to analysts’ forecasts, its revenue is projected to increase by $100 billion by 2030. Even Nvidia CEO Jensen Huang acknowledged that the OpenAI agreement with AMD is remarkable, yet poses no threat to Nvidia’s current investments, which continue to participate in the development of OpenAI and other AI startups, including Elon Musk’s xAI and data center operator CoreWeave.

Meanwhile, Nvidia announced plans to invest up to $100 billion in OpenAI and launch projects together with Oracle and Meta, building large data centers with a total value of hundreds of billions of dollars. Nvidia products account for about 70% of the costs of new AI data centers, Huang said. It is evident that since the market capitalization has reached $4.5 trillion and the company gained a dominant position in AI, as may be observed on the heatmap, it will be challenging for any competitor to surpass it.

In the race for cutting-edge technology, AMD is betting on TSMC’s 2nm chips for EPYC Venice server processors and Instinct MI450 accelerators. For comparison, Nvidia Rubin solutions are based on 3nm technologies; however, the company utilises the N3P process technology for its premium models. Switching to a 2nm process technology will allow AMD to increase performance by up to 15% or reduce power consumption by 25-30% while maintaining performance levels, further intensifying competition.

Amid these developments, analysts, major players, and even small investors expect that the AI race will continue to gain momentum, driving new alliances and capitalization growth while affecting global market indices. AMD, Nvidia – as well as Microsoft – are simultaneously engaged in a global competition for computing power, attracting investments and introducing advanced technologies, making the coming years pivotal for the entire sector.