Intel’s partial nationalization concerns many investors and experts in the semiconductor industry. Like management, market participants understand that typical government involvement in the company’s ownership doesn’t mean direct control through the corporate boards.

However, the authorities’ influence changes the priorities of the leadership. In this case, decision-making and the direction of development are increasingly focused on the political situation, rather than on commercial activities or technological development.

The main risk for Intel’s potential partners and competitors is that they will now have to deal not with the company itself, but essentially with the US government. For customers, this poses a threat that the government will begin to stimulate demand for products artificially, and market mechanisms will lose their effectiveness.

At the same time, maintaining mediocre chip performance amid artificially boosted sales may weaken the US’s position as a technology leader.

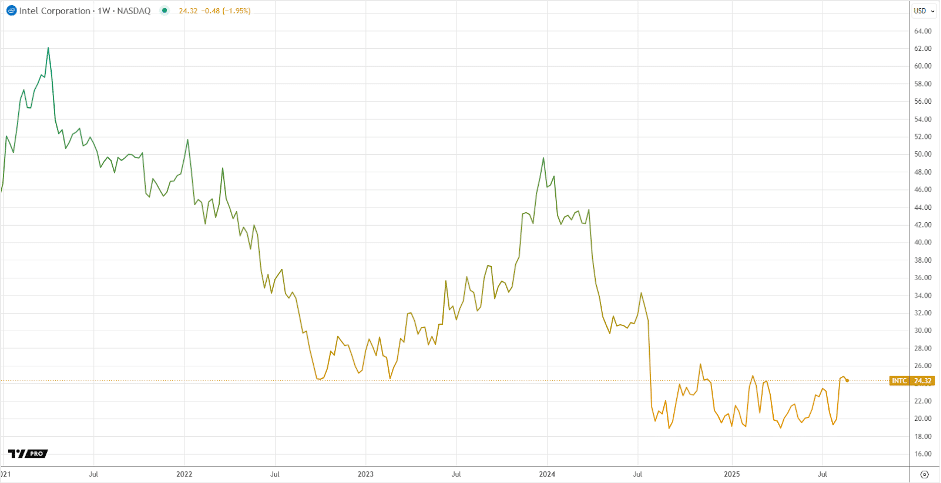

The markets have already begun to react to such news. Intel shares showed increased volatility, and the Nasdaq 100 index came under pressure amid increased uncertainty in the semiconductor sector. Since Intel is one of the index’s key components, any changes in its capitalization directly affect its dynamics and the liquidity of the Nasdaq index futures.

Since Intel is facing a high level of defects in the production of chips using the 18A technology, the production situation deserves special attention. For example, for industry leaders such as TSMC, such situations are not critical due to the company’s scale. However, for Intel, which has been recording losses for six quarters in a row, such circumstances become a serious problem that must be resolved as soon as possible.

A clear pattern shows that a vicious circle is emerging, where a high defect rate reduces interest from third-party customers, and too few orders prevent financial stabilization. Concerns about the company’s ability to compete equally with global manufacturers are only growing.

This precedent with Intel is concerning for the entire industry. Companies relying on subsidies or government support may be wary of similar involvement in their business. Investors, especially foreign ones, will be more cautious when investing in American firms. Reducing private investment remains a potential long-term risk affecting the US semiconductor industry.

Export issues that have not yet been resolved remain a separate factor. Government control over Intel can arouse suspicion from foreign buyers who are afraid of backdoors or spying tools embedded in delivered chips. Such concerns can limit sales markets, negatively affecting the company’s financial results. Additionally, the government will have more opportunities to pressure the company, which only increases distrust of products outside the country.

Thus, the partial nationalization of Intel and the problems with the production of 18A technology still look more like a source of new challenges than a solution to existing ones. In the short term, they increase the volatility of technology indices and heighten investors’s uncertainty. In the long run, the outcome will depend on how effectively the interests of the state can be combined with the need to improve production performance and maintain the competitiveness of the American semiconductor industry.