Dating apps are a hot commodity, and we aren’t just talking about the singles who populate them! Millions of people all over the world login to mainstream and niche dating apps every day— sometimes several times per day—hoping to swipe or scroll their way into a long-term relationship or to find some casual fun for short-term.

Being that dating apps are such a booming business, wouldn’t it make sense to put some money behind them? Financially speaking, it seems like a no-brainer. That’s why we are going to explore the options if you are considering investing in dating apps?

We’ll look at three publicly traded companies that indicate investment in online dating apps is well worth your time, energy, and money. We’ll show you why this might be a beneficial move on your part.

#1: Match Group (MTCH)

Current Market Cap: 15.05 billion

Revenue: 2.391 billion USD (2020)

Match Group provides dating products worldwide, owning and overseeing many mainline dating app brands. These include Match.com, Tinder, Hinge, OkCupid, OurTime, Meetic, Ship, UPWARD, and Plenty of Fish. While it seems like a no-brainer on paper to invest in Match Group, is it one of the publicly traded companies worth investing your money in?

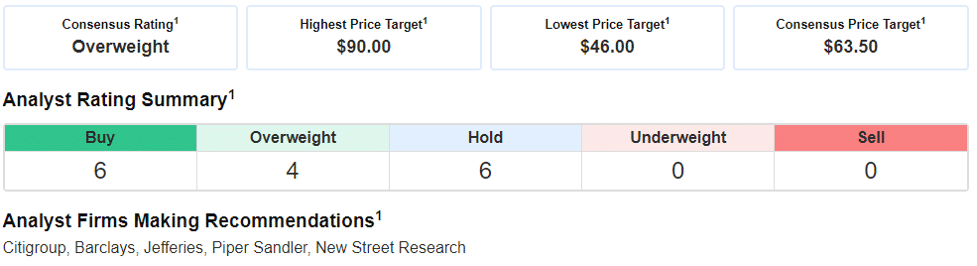

Stock Forecast

According to WallStreetZen, 43.38% of analysts recommend Match Group stock as a strong buy. The stock price is trading now at around $53.82 per share, but a year ago, it was hovering somewhere between $110 and $120. Altogether, shares are down by 52.83% over the past year. And analysts predict that the shares will reach $46 in a year, going even lower than where it currently sits. But that’s the worst-case scenario and not even that bad of a dip.

According to many analysts, Match Group is an excellent stock to purchase and hold onto. Some are hopeful that the stock price will grow by 41.58% and trade at $74.19 or (best case scenario) increase by +119.47% and trade at $115.00. If that’s the case, we recommend buying some Match Group stock and hanging onto it for a while. Take advantage of the low price, save it for a rainy day, and make some money later.

#2: Bumble (BMBL)

Current Market Cap: 3.35 billion

Revenue: 765 million USD (2021)

Bumble was founded in 2014 and is the parent company of Bumble and Badoo (founded in 2006). Bumble was established by entrepreneur Whitney Wolfe Herd, who wanted to design a platform that combined online dating, connecting with friends, and business networking. Bumble has taken its lumps recently but websites like DatingApps.com believe inflation is the cause of Bumble’s missed earnings. However, as inflation continues to cool, it might be a good time to consider investing in this company. Here’s why!

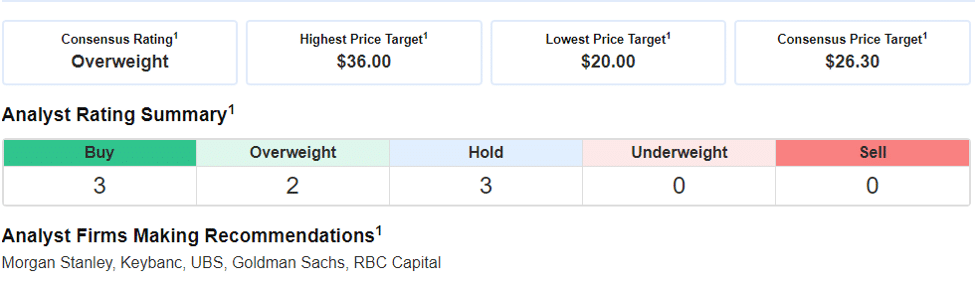

Bumble Stock Overview

Bumble is currently trading at $26.21, making it a terrific stock to invest in. The stock is one where value and growth are middle-of-the-road, at least according to the analysts at Zacks.com. According to DatingApps.com, they believe that inflation has been the cause of Bumble’s low earnings. However, as inflation continues to cool, earnings will also reflect that.

This is a good investment stock because Bumble has not always been a low-momentum stock. Sure, it is now, but given the right amount of time, those who purchase Bumble stock at $26.21 are sure to make their money back once the momentum kicks back up, and earnings begin climbing again.

#3: Hello Group (MOMO)

Current Market Cap: 1.98 billion

Let’s look at the numbers, and we’ll let you know why Hello Group is a prime opportunity. Founded in 2011 and headquartered in Beijing, Hello Group is China’s premier social networking platform and operates Momo and Tantan, the latter referred to as the Chinese Tinder. And it’s an excellent pick for investment if you’re looking to purchase dating apps or social networking stock.

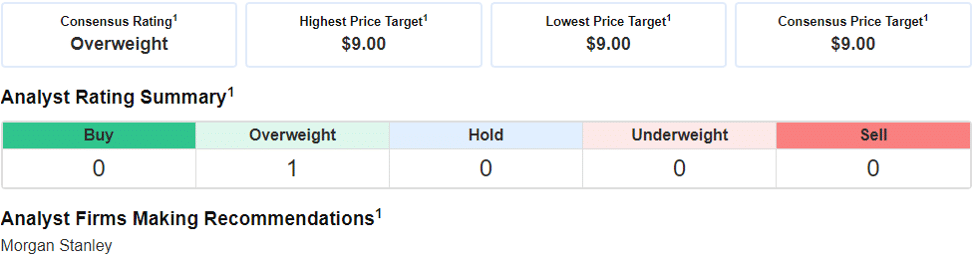

According to many analysts, Hello Group is a moderate buy, and shares sell at $10.33. The price to get in is lower than in the past, and the prime opportunity and investment timing.

According to the American Association of Individual Investors (AAII), Hello Group has high value and momentum while having average growth. Their momentum score indicates the Hello Group stock performing better in the coming days, so it’s best to invest now while the price is low.

In Conclusion

Although there are only a small number of online dating companies open to investors at the moment, there is a huge potential for growth in this market, and it is likely to continue growing.

And let’s not forget the value of dating app stocks may be even further enhanced by the advent of cutting-edge technology and innovations in artificial intelligence (AI) and virtual reality.

There is still plenty of time to invest in the rapidly growing online dating sector, as tons of new developments and opportunities are bound to boom in the future!