Bitcoin, the pioneering cryptocurrency, has advanced from a spot virtual asset to a global phenomenon, attracting investors looking for exposure for its capacity as a shop of price and hedge in competition to standard economic structures. In this text, we are going to discover key macro-inclinations shaping the Bitcoin funding landscape, inclusive of inflationary pressures, monetary policy shifts, geopolitical tensions, institutional adoption, and regulatory tendencies.

Inflationary Pressures and Monetary Policy:

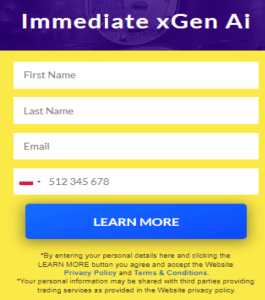

Inflationary pressures have become a developing subject for investors as applicable banks worldwide pursue expansionary economic regulations to stimulate economic growth. The brilliant degrees of economic stimulus, coupled with monetary stimulus measures, have raised fears of overseas cash devaluation and inflation. Bitcoin, with its constant supply and deflationary nature, has emerged as an effective hedge against inflation, attracting traders looking for a way to maintain buying power over the long term. Interested in learning about investing? Click the image below to learn more:

Geopolitical Tensions and Uncertainty:

Geopolitical tensions and uncertainty have traditionally inspired investor sentiment and asset charges, including Bitcoin. Heightened geopolitical risks, which consist of change disputes, geopolitical conflicts, and regulatory crackdowns, can cause marketplace volatility and flight-to-safety behaviors among buyers. Bitcoin’s decentralized nature and censorship resistance make it an attractive asset for individuals and institutions looking for a hedge against geopolitical instability and capital controls.

Institutional Adoption and Investment

Institutional adoption of Bitcoin has multiplied in recent years, with prominent investors, hedge funds, asset managers, and businesses allocating capital to the digital asset. Institutional hobby in Bitcoin has been pushed by means of factors at the side of the developing elegance of cryptocurrencies as an asset, the search for uncorrelated returns, and approximately forex debasement. The access of institutional investors to the Bitcoin market has brought improved liquidity, stability, and legitimacy to the asset, contributing to its lengthy-term funding outlook.

Technological Advancements and Innovation:

Bitcoin’s investment thesis is underpinned by its technological infrastructure and decentralized structure, which provide precise benefits over traditional financial systems. Technological upgrades, which include the Lightning Network for scalability and Taproot for privacy, promise to beautify Bitcoin’s functionality and alertness as a medium of alternate and shop of cost. Moreover, traits in blockchain generation, virtual asset custody solutions, and regulatory-compliant infrastructure are poised to draw more institutional capital and investor interest in Bitcoin.

Regulatory Developments and Compliance:

Regulatory traits and compliance necessities have emerged as huge issues for Bitcoin shoppers and marketplace people. While regulatory clarity and oversight can offer legitimacy and investor protection, regulatory uncertainty and enforcement actions can create headwinds for Bitcoin adoption and funding. Investors should display regulatory developments in key jurisdictions and check their capability to have an effect on Bitcoin’s funding outlook, together with taxation, licensing, and compliance necessities.

Investment Strategies and Risk Management:

As buyers navigate the Bitcoin investment panorama, it’s crucial to undertake sound funding strategies and threat control practices. Diversification, asset allocation, and an extended-term perspective are critical for mitigating dangers and maximizing returns within the risky cryptocurrency marketplace. Moreover, customers should be informed about macroeconomic traits, marketplace dynamics, and technological dispositions to make knowledgeable funding decisions and capitalize on opportunities within the Bitcoin ecosystem.

Conclusion:

The Bitcoin funding outlook is prompted by a myriad of macroeconomic trends, institutional adoption, technological improvements, and regulatory traits. While Bitcoin gives potential opportunities for capital appreciation and portfolio diversification, buyers need to take a look at the risks and uncertainties inherent within the cryptocurrency market. By evaluating macro dispositions, adopting sound funding strategies, and staying informed about market inclinations, traders can navigate the Bitcoin investment panorama and position themselves for lengthy-term success within the digital economic system.