Since almost everyone is interested in investing, let’s skip that debate and focus on key considerations. If you’re just starting out, major market indices can be your best option.

You might have heard of them before, but let’s take a quick look at the S&P 500, the Dow, and the Nasdaq-100. These three indices track the performance of different companies and serve distinct purposes.

Understanding the Three Major Indices

The Standard & Poor’s 500 is a market-weighted index, meaning that larger companies’ performance has a greater impact on the index. It tracks the 500 largest publicly traded U.S. companies by market capitalization.

The S&P 500 is meant to provide a broad overview of the U.S. market, which represents around 80% of the total market cap of U.S. public companies. With the U.S. accounting for approximately 25% of global GDP, the S&P 500 also offers insights into the global economy.

The Dow Jones Industrial Average Index includes 30 blue-chip companies selected by the S&P Dow Jones Indices committee. Unlike the S&P 500, the DJI assigns weight based on a company’s stock price rather than its market cap.

For example, McDonald’s has a market cap of $220 billion, while JP Morgan Chase’s market cap is $750 billion. Yet McDonald’s weight in the DJI is 3.97%, while JPM’s is 3.67%.

The Nasdaq-100 tracks the 100 largest non-financial companies listed on the Nasdaq stock exchange, which is home for tech and innovation-focused companies. Because of its tech-heavy composition, this index tends to be more volatile but generally delivers higher returns.

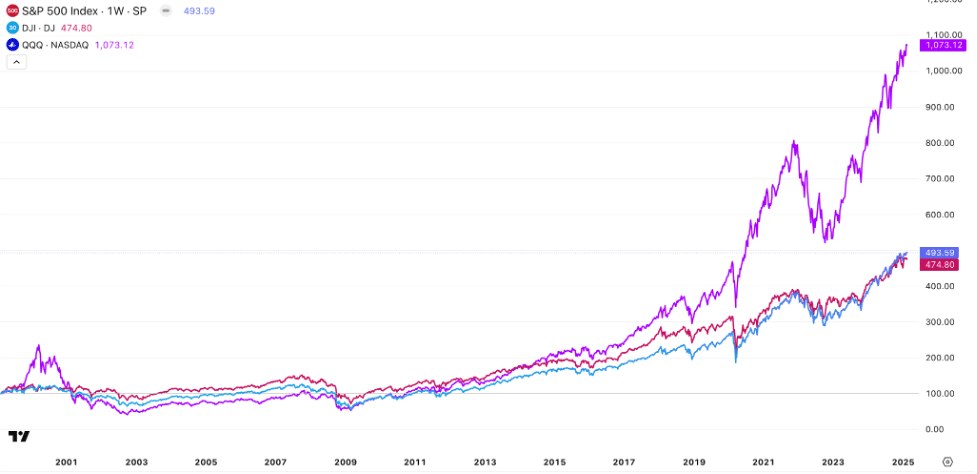

The chart below compares the performance of the S&P 500, DJI and Nasdaq-100. As you can see, they all follow the same patterns. The latest surge of the Nasdaq-100 can be attributed to the blockchain and AI revolutions.

Nuances of Index Investing

If you’re used to picking individual stocks, here are some important differences when investing in indices:

1. First, you cannot invest directly in an index. When we say invest in an index, we mean investing in financial instruments that track its index performance. For example, to invest in the Nasdaq-100 you can buy the Invesco QQQ ETF (exchange-traded fund). To invest in the DJI, you can go with the DIA ETF. And for the S&P 500 there’s the SPY ETF.

2. Second, you’re limited to the companies within the index. If you invest in the DJI, you won’t benefit from T-Mobile’s growth, since it’s not included. However, T-Mobile is part of the S&P 500. So, it’s worth reviewing the companies included in the particular index before investing.

3. Third, indices are less volatile than individual stocks. If you hold an ETF for the DJI or S&P 500, you have very little chance of losing money due to decline in McDonald’s stocks alone. However, if McDonald’s stock surges, you’ll see only a portion of the gains compared to holding McDonald’s stocks directly.

The Bottom line

Initially designed to track market health, indices have ivolved into some of the safest investment instruments. They are managed by respected and trusted authorities.

For beginners with limited capital, indices might offer a great way to get their first experience with financial markets.

*Always consult your local financial advisor before allocating your assets.