Many investors today have always preferred a passive investment package to allow them to focus on their other engagements. Hence, we find many prefering to invest in mutual funds above trading ETFs. Thus, while ETF trading involves the active participation of the trader in predicting the future prices of the group of financial assets traded, the investor who invests in Mutual Funds will not have to go through the pains of trading themselves. This is because the fund managers will have to do so on his behalf. This work has therefore examined in detail the difference between Mutual funds and ETFs. This will make it easy for investors who wish to start investing with a forex trading broker to know which financial assets they prefer.

Meaning of Mutual Funds

Mutual funds refers to a pool of capital contributed by a group of investors and handed over to a fund manager who invests them into various assets including stocks, bonds, and other securities, and delivers returns to the investors after a set period. The mutual fund allows investors to earn passive income from their investments over time by leveraging on the expertise of the fund manager in choosing the most profitable assets for investment. However, an important point to note about mutual funds investment is that there is no fixed amount to earn over time. The returns are shared based on the yields and the amount invested. The fund managers are also paid some commissions for running the investment too.

What is ETF

ETF refers to funds traded on an exchange and used to track the performance of a group of financial assets or securities such as commodities, stocks, bonds, etc. Trading an ETF allows the investor to speculate on the future prices of these groups of assets and take positions based on his forecast. The term ETF is an acronym for exchange-traded fund.

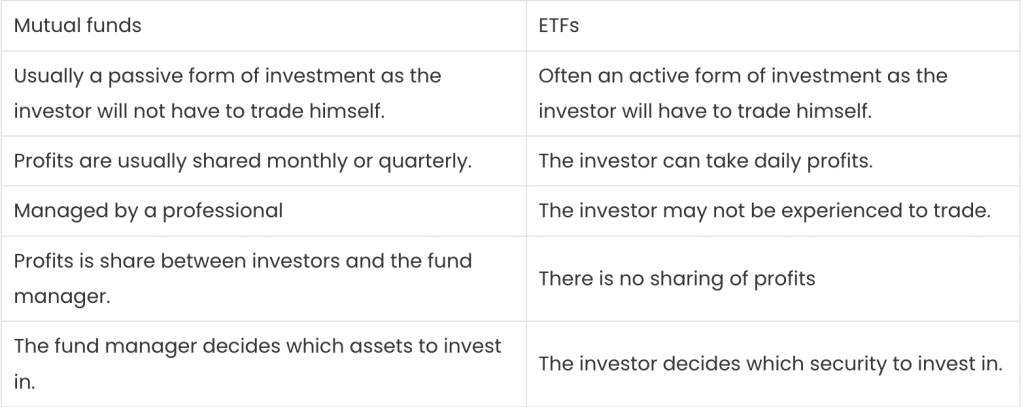

Major difference between Mutual funds and ETF

How to invest in Mutual funds

Anyone who seeks to invest in mutual funds, will need to make his choice from the list of the available mutual funds for investment today. Here, one needs to study the previous performance of the returns yielded by the mutual fund in the past years before proceeding to invest in them.

To invest in Mutual Funds, the investor will have to fill out the application form provided by the group and next submit a bank draft to the Investor Service Centres (ISC) of the Mutual Fund he wants to invest in. Some mutual funds groups usually provided the requirements for investing with them on their website.

How to invest in ETFs

To invest in an ETF today, the investor will need to create an account with the exchange or broker offering the desired ETF for trading on their platforms. Of course, the majority of brokers offer these ETFs for trading as CFDs. Next, the trader will need to fund his account and select his preferred ETF for trading on the platform. This could be stocks, bonds, commodities, etc.