For several years now, the BRICS+, an alliance of Brazil, Russia, India, China, South Africa, and other countries, has been expressing the desire to reduce dependence on the US dollar in international transactions.

Such an initiative is seen as an instrument for breaking the economic domination of the United States.

The idea of an alternative payment method has long been mooted, with China and Russia as the main powers enforcing this initiative. However, this project seems to have been put on hold or even abandoned due to serious intra-BRICS disagreements and economic constraints.

Brazil, an influential member of the bloc, states that it is interested in the dollar remaining one of the dominant currencies until 2035 due to the absence of a credible alternative in the short term.

Its government also added that the BRICS lacks the institutional cohesion to launch a new common currency, along the lines of the ECB-led euro.

Also, Donald Trump’s threats against any country considering abandoning the “almighty dollar” prompted the Indian government to reject any initiative seeking to weaken the dollar. Instead, India prioritizes stable trade relations with the United States to safeguard its foreign exchange reserves.

These contrasting positions among key players highlight a growing geopolitical divide within the bloc. While some members push for a break from the American economic order, others favor economic realpolitik. Such a dynamic is unlikely to cause a further fall of the US dollar and DXY index performance in the foreseeable future.

In the long term, the dollar is unlikely to lose its crown as the dominant fiat currency. If it is to be dethroned for a period of time, it may not be because of another state currency like Euro, which, by the way, is grabbing pips against the dollar with the EURUSD rate nudging higher, or a hypothetical BRICS currency. Rather, this may be a decentralized cryptocurrency, such as Bitcoin.

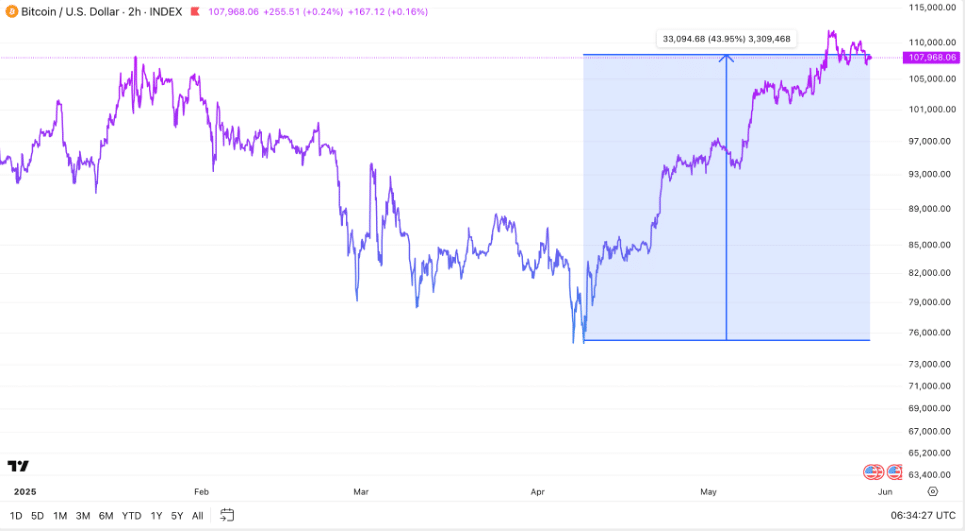

Cryptocurrencies are showing prominent growth this year. The rise in Bitcoin price undoubtedly reflects a growing trust and confidence in crypto.

As a possible alternative to the USD, which is deeply rooted in the very foundations of the global financial system, Bitcoin and other cryptocurrencies may challenge the fiat currencies, changing the global economic landscape.

Sovereign currencies have their own limitations, including extensive state control and sanctions. Politics plays a major role in their exchange rates, resulting in international trade instability.

Major economic players are starting to move toward neutral alternatives that go beyond government control. For the time being, the global economy remains tied to the dollar, and the BRICS, despite its ambitions, doesn’t yet have the ability to replace it.

Thus, de-dollarization is still held back by economic realities and geopolitical divisions. The buck still reigns supreme, and if a challenger is to emerge, it may come from decentralized finance rather than from governments.