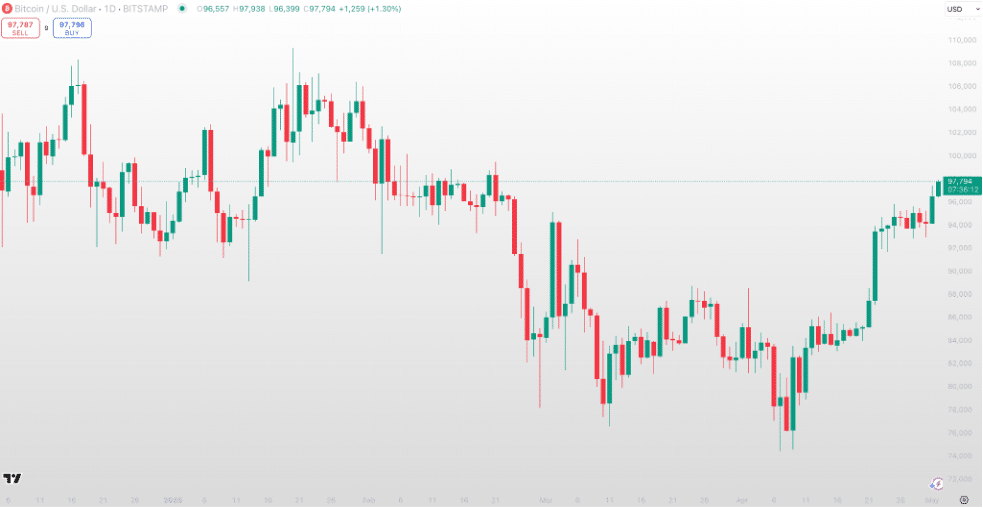

The first quarter of 2025 has just ended on a mixed note for the U.S. economy, marked by a contraction of 0.3%. This unexpected dip has reignited fears of a possible return to recession. It may have caught many off guard, but this economic turbulence has created an opportunity for alternative assets, including cryptocurrencies, and their undisputed king, Bitcoin.

Historically, Bitcoin has moved in tandem with stock market indices, particularly technology stocks. But it is now showing an increasingly independent dynamic. In this sense, it resembles gold in its role in investment portfolios, as an antifragile asset that is less sensitive to economic swings or corporate performance. In a recessionary environment, this trait is especially valuable.

The likelihood of a recession is growing, and markets are hoping for a shift in U.S. monetary policy. According to JP Morgan, most analysts expect the Fed to cut interest rates by July 2025, with projections suggesting a target range of 3.75 and 4%. The U.S. authorities aim to mitigate the economic fallout from tariffs imposed by the Trump administration. On top of that, the U.S. dollar has not been in great form since the start of the year — another bullish signal for Bitcoin, which has historically moved inversely to the dollar.

Institutional factors are also playing a role. States like Arizona are considering including BTC in their strategic reserves, and Donald Trump himself made a similar announcement at the federal level. While these announcements are marginal for now and have not yet been followed by concrete action, they add a layer of legitimacy that institutional investors look for.

This environment could drive Bitcoin prices higher in the short to medium term. Currently standing at around $97,000, the leading cryptocurrency is supported by multiple catalysts: lower interest rates, a depreciating dollar, and rising institutional interest. All together, they make a strong case for continued bullish momentum, especially in a financial environment hungry for high-performing asset classes.

In short, Bitcoin doesn’t just seem unbothered by recession risks; it may actually benefit from them. The cryptocurrency looks set to reach new heights in its evolution and establish itself as an alternative gauge of investor confidence.

What’s more, we may be witnessing the early signs of the first viable alternative to the dollar, that risks to drag down the global economy due to unpredictable decisions taken in Washington. If no other government-backed currency (like euro or yuan) can step up a credible alternative, due to geopolitical, institutional or trust-related issues, we could be looking at a future where the ‘post-dollar’ world isn’t dominated by another fiat currency, but by a blockchain asset like Bitcoin. Despite its imperfections, Bitcoin may soon be seen not just as a speculative bet—but as a systemic necessity.