Nexus International’s first-half figure, $546 million in revenue, up 110% year on year, says something about demand. Its method says more about how the company intends to compete. Rather than chase attention with broad campaigns or headline partnerships, Nexus has built a playbook that prizes being “first to readiness”: secure permissions, stand up local operations, wire payments and risk controls, then scale. Marketing follows infrastructure, not the other way around.

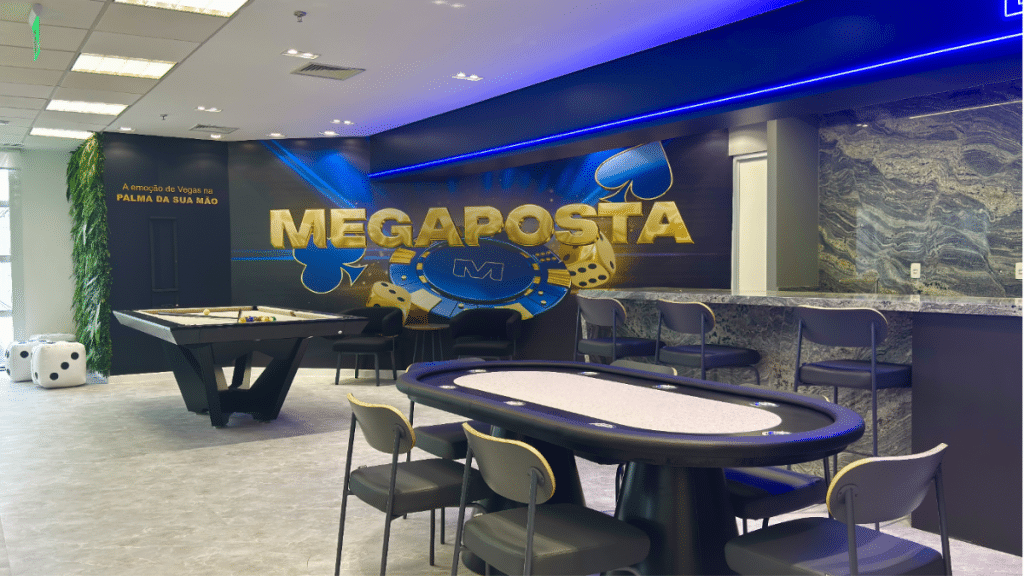

That sequence is visible in Brazil. Megaposta, Nexus’s local brand, didn’t arrive with blare; it arrived licensed, staffed and operational, and closed 2024 with roughly $400 million in revenue. The company has since opened a regional office in São Paulo, a practical acknowledgement that proximity matters in a region where regulations evolve unevenly and speed to compliance often dictates speed to market. If the point is to reduce the time from legal clarity to go-live, a hub lowers the friction: counsel in the room, vendor contracts handled in-country, and operations recruited from the same talent pool they will serve.

The first half of 2025 extends that pattern across the portfolio. Spartans and Lanistar, alongside Megaposta, are contributing early and in different ways: one tuned for high-frequency, crypto-comfortable users; the other built to run across multiple jurisdictions with a mobile-first posture. The brands differ; the spine does not. Payments orchestration, risk tooling, identity workflows, and support operations are increasingly shared, which is where operating leverage comes from in this category. The outcome is less a single “breakout” channel and more a system in which units strengthen one another as volumes rise.

This is not the industry’s default. Large incumbents, Bet365 and DraftKings among them, enjoy brand gravity, media reach and established league or broadcast ties. Their advantage is breadth. Nexus does not try to mirror that. Its edge, if it persists, will come from something more prosaic: being locally ready faster than rivals when regulation formalises, and keeping unit economics intact once live. That translates into a long list of uncelebrated chores, source-of-funds checks that clear quickly, payout rails that stay liquid during peak events, ledger reconciliation that passes audit the first time. None of these items sell airtime; all of them create retention.

The financing posture supports the operating logic. Nexus has grown without external capital. That removes one source of volatility, board-level taste for pace, and focuses attention on the parts of the P&L the firm can control. It also imposes its own discipline. Internally funded expansion leaves little room for theatrical mistakes. Projects need to earn their keep, which has a way of sharpening specifications and shortening meetings. There are trade-offs: a self-funded model can be slower to seize land-grab opportunities, and it offers fewer buffers if a market shuts suddenly. But for a company that views readiness as strategy, the benefits are clear: fewer external clocks to obey, more time for groundwork.

The numbers leave room for interpretation. With $546 million booked at mid-year, the group remains some distance from its $1.45 billion projection. The gap is notable. So is the shape of the first half: growth distributed across three labels, not concentrated in a single promotional spike; a regional hub established to accelerate future launches; and an internal platform consolidating the plumbing that determines margin. If the second half looks similar, the annual target may still be ambitious, but the operating pattern becomes harder to dismiss.

A useful way to view Nexus is less as a single operator and more as a sequencer. The company’s work tends to occur in a predictable order: legal interpretation, vendor and banking alignment, risk policy codification, service-level thresholds, and only then user acquisition at scale. A similar sequence shows up inside teams. Projects start small, are measured against explicit thresholds, fraud loss, approval latency, abandonment, and are either promoted or cut. This lends the whole enterprise a factory-floor feel, even though nothing physical is being produced. The metric is throughput, not noise.

There are obvious risks. Regulation is not merely complex; it is political, and politics can change suddenly. Payments and identity standards are moving targets. Incumbents are learning, and can absorb playbooks they did not originate. And attention brings its own distortions: quiet operators sometimes get noisier when rankings arrive. Whether Nexus can preserve its cadence as scrutiny rises will be a cultural test as much as a technical one.

What to watch next are signals that rarely merit a press release. Do licensing timelines shrink now that São Paulo is staffed? Do the three brands converge on loyalty and support systems that reduce duplication? Do time-to-payout and dispute-resolution windows tighten as volumes grow? Each is a small indicator; together they tell you whether “first to readiness” is a slogan or a system.

For now, the midyear picture is clear enough. Nexus has posted a strong first half, with growth that appears earned rather than rented. It has arranged itself to move when rules settle, not when headlines do. And it has chosen to spend on the parts of the stack that hold under stress. In an industry that often mistakes volume for velocity, that is a quiet, specific bet. The coming quarters will show whether being ready first is also enough to endure.