Drowning in debt? Many American households are in the same boat. With credit card balances, student loans, mortgages, and more, debt has become a reality for millions. However, not all debt is created equal. Key to getting one’s financial house in order is understanding the different types of debt, how they impact credit and finances, and strategic ways to pay them down.

In this post, there will be a real yet judgment-free conversation about secured vs unsecured debt, revolving vs installment accounts, interest rates, loan terms, and how it all impacts credit scores and mental health. Real-life examples and actionable tips will be shared so readers can finally see the light at the end of the debt tunnel and take control of debt – it’s possible! This post aims to arm readers with the knowledge to understand their debt composition and make strategic plans to improve their financial health.

Secured vs. Unsecured Debt: What’s the Difference?

Debt is categorized as either secured or unsecured, which greatly affects everything from the interest rates and fees charged to the consequences should one default or fall behind on payments. Secured debt refers to loans that are tied to collateral – typically assets like a house, car, or securities account. The loan and collateral are linked, meaning if you stop making loan payments, the lender can seize the asset to recoup their losses.

Common types of secured debt include mortgages, auto loans, boat loans, and home equity lines of credit. With secured debt, the collateral you pledge reduces the lender’s risk, allowing them to offer more favorable interest rates and repayment terms. However, falling behind on secured debts is extremely risky since defaulting could mean losing a home, car, or other asset that may be essential.

On the other hand, unsecured debt does not have any specific asset acting as collateral. If payments cease, the lender does not have a direct claim on any property but rather must take other legal routes to recover losses, such as sending accounts to collections agencies or pursuing wage garnishment. Common unsecured debts include credit cards, medical bills, personal loans, and utility payments.

The higher risk for lenders generally means higher interest rates and fees and lower credit limits for unsecured debts. However, the consequences of default, while still quite serious in terms of credit score damage, are generally not as catastrophic as defaulting on a secured loan linked to an asset you depend on.

Revolving vs. Installment Loans: What’s the Difference?

Beyond the secured versus unsecured debt status, consumer debt also falls into two additional structural categories: revolving debt and installment loans. Understanding the dynamics of each is key to managing credit and building credit scores.

Revolving Debt

This flexible borrowing arrangement allows you to continuously take on debt, make payments toward what you owe, and borrow again up to a set credit limit. It is an open-ended line of credit. Your monthly minimum payment due fluctuates based on how much you currently owe against your limit at any given billing cycle.

Common examples of revolving debt include credit cards, home equity lines of credit (HELOCs), and some personal lines of credit offered by banks. With revolving debt, interest is typically calculated using your average daily balance for the billing period. This means higher outstanding balances rack up more interest expenses.

From a credit scoring perspective, keeping revolving utilization as low as possible by not overspending credit limits is crucial, as high balances compared to limits on credit cards and other revolving accounts can really ding scores.

Installment Loans

These are closed-end loans in which you borrow a fixed amount upfront, which is then repaid in equal monthly principal and interest payments over a set period. Your access to continuing credit is limited to that original loan amount.

Installment loans include mortgages, auto loans, personal loans, and student loans. Interest is calculated based on your declining loan principal as payments are made each month. The mix of installment loans along with revolving accounts helps demonstrate you can manage diverse credit types responsibly.

Revolving facilities provide flexible but potentially risky access to continuing credit, while installment loans build your credit mix profile but within defined limits. Managing these different types of debt, especially in high-cost living areas like New York, can be challenging. For New Yorkers struggling to keep up with their debt, seeking out New York debt relief options can provide a pathway to better financial health. Various programs and services in New York offer tailored advice and solutions for individuals looking to manage their revolving and installment debts more effectively, ensuring they can work towards a stronger financial future without being overwhelmed by the burden of debt.

Navigating Interest Rates and Terms

The specifics of the interest rates and accompanying loan terms attached to any debt obligation have an enormous impact on the total cost of borrowing and one’s ability to manage repayments flexibly. Yet interest rate types and loan terms are often buried in the fine print of lengthy credit agreements and obscured by industry jargon. It pays to educate yourself on how rates and terms work before taking out new debts so that you understand the full costs and constraints.

Interest rates can either be fixed or variable. Fixed-rate debt maintains the same interest rate throughout the full loan term. This offers predictability in monthly payments.

Variable rate debt is tied to market indexes and fluctuates over time by broader interest rate trends. The initial rate on variable rate loans is often very low or even 0% to attract borrowers, but it can spike suddenly as markets shift. Comparing just the starting rate on a variable loan to a fixed-rate loan does not show the full picture of potential costs. Look at historical rate trends to see how high variable rate products can go.

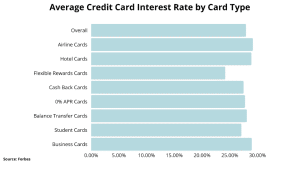

The chart below shows the average credit card interest rates by card type as of Feb 2024 in the U.S

Even more important than the base interest rate is examining the Annual Percentage Rate (APR), which encompasses not just the interest rate but any fees, points, or other costs rolled into the total cost of the loan. Longer loan terms mean lower monthly payments but higher total interest paid over the full repayment period. Consider any prepayment penalties or restrictions when weighing loan term options.

Grasping these basics is key when exploring homeowner types of mortgage refinance options. Whether aiming to reduce monthly payments, decrease loan terms, or access home equity, selecting between fixed-rate and variable-rate refinancing shapes your financial approach. Each refinancing type offers distinct rates, terms, and conditions, influencing your financial future. Informed decisions on these options ensure alignment with your financial objectives and market trends.

Debt Type Comparison

| Debt Type | Interest Rates | Fees | Credit Score Impact |

| Mortgages | Usually lowest, 3-6% | Origination, application fees | Helps mix of credit types |

| Auto Loans | Lower, 3-12% typically | Origination fees | Helps mix of credit types |

| Credit Cards | Very high, often 15%+ | Annual, late payment fees | High utilization hurts scores |

| Personal Loans | Variable, 5-36% | Origination fees | Helps credit mix if managed well |

| Student Loans | Varies on type, 4-12% | None of the origination fees | Helps credit mix |

| Payday Loans | Extremely high, 100-400% | Service fees | Hurts if mismanaged |

This table summarizes average interest rates, common fees, and general credit score impact across common consumer debt types. Use it as a quick reference when evaluating new borrowing options.

How Debt Composition Impacts Financial Strategy

Not all debt is created equal, and the unique composition of your debt portfolio should directly inform strategies for rapid repayment and improving your credit score. For example, credit card and personal loan debts often carry some of the highest interest rates and most onerous terms, and thus making extra payments toward high-interest revolving debts while maintaining minimum payments on lower-rate installment and fixed debts is usually the smart play.

However, composition factors beyond straightforward rate comparisons matter enormously in real-world debt scenarios. The total balances of each loan, for instance, influence the psychological motivation to tackle debts aggressively or chip away more slowly. Knocking out a few small credit card balances quickly can offer the motivation to then take on larger, lower-rate debts that nonetheless drag heavily on overall finances.

Also, comparing the status of debts as secured vs. unsecured as well as the accompanying financial and emotional consequences of default makes a significant difference. Defaulting on mortgage or auto debt tied to necessary assets is far more catastrophic than falling behind on unsecured credit card payments, for example. No single factor – rates, balances, terms, collateral, emotional weight – exists in a vacuum. Look at the full debt picture holistically when strategizing the optimal path.

The Psychological Weight of Debt

In addition to the financial costs, debt – especially high amounts of toxic debt products like credit cards or payday loans – exacts a tremendous psychological and emotional toll. Researchers have found strong correlations between high debt balances and increased anxiety, depression, stress, and other harmful mental health impacts. Beyond just numbers on a statement, debt hangs over daily decisions and quality of life in palpable ways.

Certain types of debt carry specific emotional weights and challenges. High-balance debts, for instance, can simply feel demotivating and insurmountable, sapping energy and hope from efforts to repay. Even when refinancing options exist to reduce interest costs, the sheer inertia of such a large balance can make it tempting to avoid confronting the issue instead of more pleasant activities. High-interest debt also stresses urgent action, yet focusing continually on past “mistakes” breeds unnecessary self-judgment.

For secured debts like mortgages, the house it provides forms part of one’s identity and self-worth. Facing potential foreclosure creates extreme psychological strain. Similarly, for student loan borrowers, debt from education can represent disappointment, shame, or a feeling of the wrong path taken. Assessing the emotional and psychological baggage that different debts carry is vital when prioritizing repayment.

Frequently Asked Questions

- What’s the most effective strategy for paying off mixed types of debt?

Evaluate interest rates, balances, loan terms, collateral risks, and emotional factors for each debt. Rank by priority, focusing on high-rate, unsecured debts first while maintaining minimum payments on lower-rate, secured debts. Eliminate small balances quickly for motivation.

- How do different types of debt impact my credit score?

Debt composition influences scores. Having some installment loans helps build a credit mix. Keeping revolving balances below 30% of credit limits helps credit utilization. But most importantly, make all payments on time. Payment history drives over 30% of scores.

- Is it ever beneficial to take on new debt to pay off existing debts?

Sometimes. Debt consolidation loans or balance transfers to new 0% credit cards can save on interest. But this carries risk, namely accumulating more debt and damaging credit scores if not managed prudently. Only consider if you can pay transferred balances off before rates spike.

- Should I focus on paying down higher-rate or lower-balance debts first?

Look at the whole picture. Eliminating a small, high-rate credit card balance gives a quicker sense of accomplishment which builds energy to tackle larger debts. But dragging out a massive high-rate debt with compounding interest is costly. Balance motivation and math.

- Should I pause retirement contributions if I have high-interest debt?

Generally no, as retirement contributions essentially earn a 100% return equal to the match. Just be sure to allocate extra funds freed up from hitting 401(k) contribution limits towards that high-interest debt. Don’t let retirement savings become an excuse for neglecting urgent debts.

- How do I know when I’ve taken on an unhealthy amount of debt?

If your monthly debt payments start exceeding 20% or more of your take-home pay, it makes meeting other living expenses and savings goals difficult. Also, if you find yourself struggling to make even the minimum monthly payments on what you owe, it’s time to rein in borrowing and create a plan to pay down balances.

- Should I use a debt consolidation company or manage it myself?

Debt consolidation services can provide experienced guidance on managing what you owe, but they also carry fees for that assistance. Doing it yourself is cheaper but requires discipline and proactivity. Evaluate the upfront costs of services versus your personal need for structured debt management support.

- What’s the first step to taking control of problem debts?

The first step is admitting you have an unhealthy debt situation and doing a complete inventory of precisely what you owe across all accounts. Awareness, accountability, and an eagerness to change habits and behaviors around spending and borrowing are the necessary starting points.

- How do I stay motivated during a long debt payoff journey?

Celebrate even small, incremental milestones and visualize the emotional benefits of freedom from oppressive debt burdens. Share both your struggles and commitment with supportive people who can encourage you along the way.

- What should I do if I miss debt payments due to sudden job loss?

If you miss payments due to unexpected loss of income, immediately contact all your lenders to explain the situation openly and request alternative payment arrangements tailored to what you honestly can afford now. Ask what options they may have for deferred or reduced payments.

Conclusion

Managing debt effectively starts with understanding the different types comprising your unique debt portfolio, from secured loans to credit cards. Evaluate interest rates and loan terms closely before borrowing. Make a repayment plan that tackles high-interest, unsecured debts aggressively while maintaining minimums on secured, lower-rate debts. Don’t ignore emotional factors that influence motivation.

Become a savvy borrower, maximize your monthly debt payments, and take control of your financial health. With education, discipline, and commitment to changing habits, freedom from debt is possible. The journey starts with comprehension – arm yourself with knowledge to make smart borrowing choices and get ahead of debt.