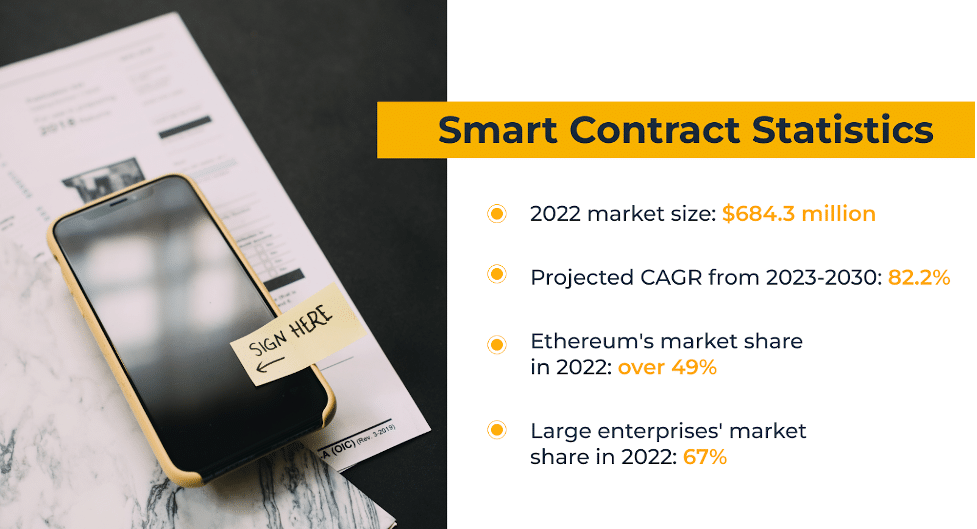

In recent years, the term “smart contracts” has surged in popularity. In 2022, the worldwide smart contract market was valued at USD 684.3 million. Experts predict it will grow at an 82.2% CAGR (compound annual growth rate) from 2023 to 2030.

Yet, as their prominence grows, so does the legal ambiguity surrounding them. Many businesses and individuals are wondering: are smart contracts legally binding? In this article, we take a closer look at smart contracts, their legal status, and ways to enforce them. Let’s start!

Smart Contracts: A Comprehensive Overview

Smart contracts, while revolutionary, are still a mystery to many. Let’s demystify them.

What is a Smart Contract?

A smart contract is a self-executing agreement written as code. They owe their robust security and transparency to blockchain technology. Smart contracts record all actions and transactions on a blockchain. This makes the records secure from tampering and easy to check.

Smart contracts:

- were first introduced on the Ethereum blockchain in 2015.

- simplify financial transactions without trusted intermediaries, a hallmark of traditional finance.

- are open-source, making them a significant channel of financial innovation.

Smart contracts can set and enforce rules written in code, but they don’t always link to actual legal rights or duties. So, the events they trigger don’t always create a new, legally-recognized contract.

How Do Smart Contracts Work?

Smart contracts run on shared systems that track transactions, a concept that became famous with Bitcoin in 2008. This technology has led to more interest in making deals without needing a middleman. New companies have emerged with a focus on smart contracts. They have taken these contracts to new levels, beyond Bitcoin’s original scope.

Smart contracts are self-executing codes that empower complex automated functions. Programmers write these codes in the Solidity programming language. They work with the Ethereum Virtual Machine (EVM) – an interface between the executing code and the machine.

But, it is worth noting that although the Ethereum segment dominates the market (49% of total revenue), there are other platforms, such as

- Innowise Group

- iTechArt

- 4soft

- Algorand

- IBM

- TATA Consultancy Services Limited

- Chainlink

- ELEKS

- Waves Technologies

Smart contracts follow an “if-then” rule. So they automatically trigger actions when users fulfill specific conditions.

For example, once a buyer makes a payment for a property, the contract transfers ownership. These contracts, coded instead of written in natural language, leave no room for interpretation. All participants can see the code, ensuring it’s transparent and secure from tampering.

Categories of Smart Contracts

Different categories exist for smart contracts, including:

1. Financial

These relate to the gathering and redistribution of funds and include things like ICOs (token sales to raise funds for blockchain-based projects).

2. Operational

The execution and memory management of smart contracts play a role in resource allocation and use.

3. Token-related

These smart contracts deal with the generation, indexing, and dismissal of tokens. They often involve the approval and management of Ethereum Request for Comments (ERC) standards, such as ERC20 and ERC721.

Weighing the Benefits and Drawbacks

Smart contracts offer many advantages:

- Smart contracts streamline processes, minimizing human errors and intervention.

- Their applications cover different sectors, from financial transactions to corporate governance.

- They allow parties to set conditions in advance, ensuring automatic execution upon condition fulfillment.

But, they’re not without their challenges. The primary disadvantages of smart contracts include:

- Once deployed, smart contracts are difficult to change or stop.

- Potential vulnerabilities include transaction-ordering dependency, timestamp dependency, and mishandled exceptions.

A major worry is that bugs in the code might cause unexpected problems or allow for exploitation. To mitigate this risk, thorough testing and auditing of smart contracts are essential.

For example, U.S. bankruptcy law has a rule called the “automatic stay.” This rule gives people who owe money a break from debt collectors while they sort out their finances. But smart contracts might not follow this rule. They run on their own once they start. The law says that when someone files for bankruptcy, debt collectors must stop all actions. But a smart contract might keep going. It doesn’t know how to stop for legal reasons.

This issue shows why it’s smart to plan and talk to a lawyer when you use smart contracts. This is important for deals that involve a lot of money or might intersect with bankruptcy laws. If you’re thinking about how much it costs to get legal help with these things, there are guides like https://nearu.pro/lawyers/how-much-do-bankruptcy-lawyers-cost that can help. They explain the costs of bankruptcy by chapters and extra expenses and challenges, so you know what to expect.

Despite the promising potential of smart contracts, there are hurdles to overcome. A barrier is the general lack of understanding about their workings, which can slow down adoption rates. Also, the industry faces a talent gap, with a pressing need for professionals adept at developing and managing smart contracts.

Smart Contract Examples

Smart contracts have found applications in various industries and use cases. Here are a few examples:

1. Supply Chain Management

Smart contracts can automate and track the movement of goods across the supply chain, ensuring transparency and enhancing efficiency.

2. Real Estate

Smart contracts can execute the transfer of property ownership as soon as they receive payment and confirmation.

3. Insurance Claims

Smart contracts can automate the claims process, reducing the need for manual verification and expediting the settlement process.

Legal Landscape of Smart Contracts

The legal landscape surrounding smart contracts is still evolving. Governments are exploring guidelines to address the challenges and opportunities of this technology. Let’s take a closer look.

Smart Contracts Regulation

In the USA, several states have passed laws recognizing the legality of smart contract transactions. But, a national framework is still in the works.

Tennessee has embraced Distributed Ledger Technology (DLT) and smart contracts. In simple terms, DLT is a shared, replicated ledger that can use electronic currencies. Smart contracts in Tennessee are computer programs that automate transactions. The state recognizes signatures and records made via DLT, emphasizing that smart contracts are valid in commerce.

Arizona has a similar approach. The state defines blockchain as a type of DLT and acknowledges smart contracts in commerce. If you use blockchain in Arizona to secure information, you keep your ownership rights, unless the contract specifies otherwise.

Nevada’s approach is more comprehensive. While it recognizes blockchain and smart contracts like electronic records, it sets clear boundaries. For instance, blockchain can’t replace traditional methods for critical legal notices. This balanced approach ensures innovation while safeguarding essential legal processes.

Now let’s look at what goes on with regulation in Europe.

The European Parliament’s proposed Data Act has implications for smart contracts. At its core, the Act emphasizes data sharing and access. For smart contracts, this means:

- Ensuring data sharing conditions are met.

- Making data access user-friendly and immediate.

- Following data sharing conditions, especially with gatekeepers.

Also, with global data protection regulations like the EU’s GDPR, smart contracts must focus on data safety. They should:

- Protect user data.

- Get user consent before data collection or sharing.

- Allow users to request data erasure, in line with GDPR.

The rules for smart contracts are changing. Some U.S. states have their own rules, but there’s no federal law yet. The EU is working on aligning data rights with new technology. As smart contracts grow common, laws will try to protect people while allowing innovation.

Before using smart contracts, companies and people need to know the legal side. Getting legal advice and following the law can reduce risks and make sure these contracts hold up in court if needed.

Is a Smart Contract Enforceable in Court?

The U.S. Electronic Signatures in Global and National Commerce Act (ESIGN) grants electronic contracts the same legal stature as traditional ones. Thus, if a smart contract meets all legal requirements, it can be enforceable. Yet, challenges arise when disputes occur, given the contract’s immutable nature.

It is important to note that while smart contracts can automate certain aspects of contract execution, they may not encompass all legal considerations or be suitable for every type of agreement. Complex contracts or contracts involving significant amounts may still need traditional legal documentation.

What Are the Legal Issues with Smart Contracts?

And now, let’s take a look at the main legal issues of smart contacts.

Intellectual Property Concerns

IP rights can become complex when entwined with blockchain and smart contract technology. The decentralized nature of blockchain often leads to questions about who owns and controls IP in the field of smart contracts.

Resolution:

To navigate IP rights within smart contracts:

- Parties must outline and agree on IP rights within the smart contract’s terms.

- Install licensing agreements that detail the rights for using, sharing, and altering the software or content.

- Use conventional contracts to address any IP issues not covered by the blockchain.

Enforceability and Legal Standing

The legal status of smart contracts varies across regions, creating uncertainty about their enforceability.

Resolution:

To ensure smart contracts are legally sound:

- Collaborate with legal authorities to create frameworks that recognize smart contracts.

- Combine smart contracts with traditional legal contracts to guarantee enforceability under existing laws.

- State the governing law and legal remedies in the smart contract to avoid jurisdictional confusion.

Consumer Protection

Smart contracts might bypass consumer protection laws, leading to concerns over liability and accountability.

Resolution:

To safeguard consumer rights within smart contracts:

- Make smart contracts clear and understandable to all parties.

- Check smart contracts against consumer protection statutes.

- Include mechanisms within smart contracts for resolving disputes and protecting consumers.

Liability Allocation

The automated execution of smart contracts raises questions about liability for mistakes or unforeseen outcomes.

Resolution:

To address liability in smart contracts:

- Audit and test smart contracts to reduce errors before they go live.

- Integrate clauses in the smart contract code that define liability and error handling.

Data Protection and Privacy

Blockchain’s immutability and transparency can clash with data protection laws like the GDPR.

Resolution:

To reconcile smart contracts with data privacy:

- Use techniques to anonymize personal data on the blockchain.

- Keep sensitive information off the blockchain, using only references or cryptographic hashes on-chain.

Fraud Risks

Blockchain’s pseudonymity can heighten the risk of fraud and illegal activities.

Resolution:

To mitigate fraud in smart contracts:

- Enforce ‘Know Your Customer’ (KYC) and ‘Anti-Money Laundering’ (AML) procedures to confirm user identities.

- Audit smart contracts and fix security gaps.

By solving legal issues early with planning, people can use smart contracts safely and make the most of their advantages. As the technology gets better, so will the laws and ways to deal with problems, helping this new area to develop.

Summary

Smart contracts can streamline your business, but it’s important to get them right. Different countries legally recognize them, and they have the potential for widespread adoption. Work with experts to make sure your contracts are solid and legal. This smart move will keep your deals safe and give you an edge over the competition.

FAQ

- Are smart contracts legal in the USA?

Yes, smart contracts are legal in the USA. The ESIGN Act establishes that electronic contracts, like smart contracts, are legally binding like traditional paper contracts.

- Can smart contracts be trusted?

Smart contracts are reliable when properly written and securely tested.

- Who owns a smart contract?

The person or group who first puts the smart contract on the blockchain owns it, but they can pass on ownership, share it with others, or remove it entirely.