Accurate financial forecasting is critical for the growth of a company as it gives actionable goals and directions to a company on financial matters. But relying on the wrong historical data to make decisions can negatively impact the business.

For reliable financial forecasting to happen, the Finance team has to receive accurate and efficient business expense data. If a company relies on the laborious and time-consuming manual expense management process, there’s a chance that the data they receive will be inaccurate.

So how can companies ensure they receive accurate expense data for reliable future predictions?

It is possible through modern technological solutions. With the onset of the fourth industrial revolution, we see technology paving the way for significant transformative changes. It is radically changing various sectors, including the finance industry.

Digitization can increase productivity by taking over the mundane tasks of manual data entry and corrections that bog down Finance and Accounting professionals. Additionally, it can empower teams to make strategic plans and decisions based on reliable data. This ensures business decisions are always number driven.

Why is financial forecasting important for a company?

Every company, big or small, needs financial forecasting to plan for incremental growth. Financial forecasting enables finance professionals to identify expenditure trends, future revenue, and financial leaks. It is an integral part of the company growth process.

Additionally, with insight into past financial information, finance professionals can make better strategic plans and decisions. Having the ability to forecast financial outcomes can also help the Finance team to do budgeting and expense management more efficiently and correctly.

How can artificial intelligence (AI) benefit finance professionals?

Finance teams need data to forecast their financial outcomes.

Since accounting and finance tasks are notoriously document-centric, it is definite that there will be no shortage of data. The finance team can utilize all the business data available from employee receipts to invoices to purchase orders and expense reports.

But how much of this business expense data is clean and reliable?

Also, as the company continues to grow and scale, the number of expenses and transactions also increase. This makes the entire task of expense reporting tedious, stressful, and time-consuming for humans to manually process and make sense of vast amounts of data.

So, how can Finance teams achieve their goals while reducing costs and time taken?

Fortunately, with technological advancements, we live in the age of artificial intelligence and its applications- big data, machine learning, and automation. With the implementation of AI, machines can perform tasks that typically require human intelligence.

- AI software eliminates the chances of human-prone errors and saves time, effort, and resources.

- AI-powered machines can gather and process massive amounts of data that can otherwise be cumbersome and time-consuming for humans.

- Machines can take over the repetitive tasks of data entry, analyzing several documents, and gathering data from disparate sources.

- Along with the gathering and processing of data, AI can help the Finance team identify spending patterns and spending trends within the organization.

- With big data analytics, the Finance team can look at clean collated data in the form of detailed reports and make data-driven decisions.

This takes care of all the mundane tasks that can free up accountants, and finance professionals, enabling them to be more efficient and productive.

How can an AI-based expense management software help with financial forecasting?

For the finance team to make an accurate forecast, they must have clean and well-documented expense data that can be mapped across categories to gain useful insights.

But the task of expense management is not easy. It involves tracking all business receipts (both paper and e-receipts), checking for policy violations, and ensuring timely expense reporting.

Manually doing all these tasks can become mundane and repetitive and can take up a lot of time. This, in turn, can affect employee morale and productivity. Unintentional errors can also occur, which can result in inaccurate and faulty insights into company spendings.

To address these challenges, the Finance team can turn to an AI solution such as an expense management software. With the help of the software, the Finance team can manage business expenses in one place, identify risks and opportunities, and gather insights from the expenses.

Here’s how an expense management software can aid Finance teams to make accurate financial forecasting:

- By making expense reporting easy and reliable

Finance teams receive most of the business expense data from their employees. Whenever an employee makes a business expense, they have to record the costs and submit an expense report. The expense report can be used for employee reimbursements, expense tracking and ensuring businesses stay ready for tax season.

In the manual expense reporting process,

- Employees have to spend hours recalling, recording, and collating expense receipts.

- It can take up a considerable chunk of the employee’s time, and the process can be taxing.

- The complicated process can discourage employees from submitting their reports on-time, resulting in expenses going unreported.

- It can also give leeway for policy violations and frauds.

Eventually, manual expense reporting can be attributed to inaccurate financial forecasting.

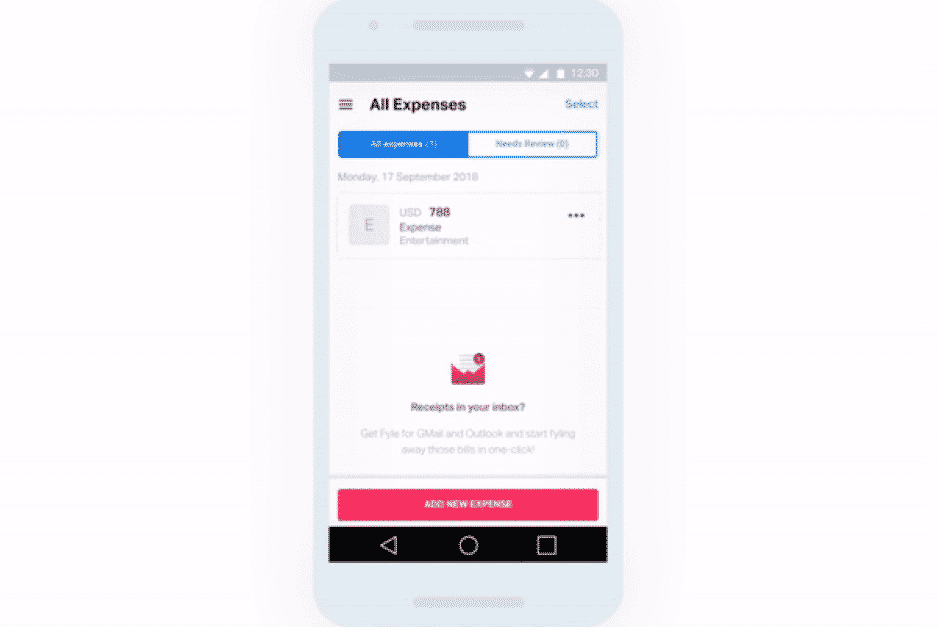

But with an expense management software, the task of expense reporting is effortless. Employees no longer have to hold on to pesky paper receipts or spend time searching and collating them. Most expense management software also have a mobile app with an in-built receipt scanning feature that can turn paper receipts digital in just a few seconds.

Employees can make an e-receipt by simply placing the receipt in front of the mobile and taking a picture of it. After capturing the paper receipts, the OCR technology scans and extracts all the vital information, eliminating the need for employees to enter data manually.

An example of the receipt scanning feature is shown below by an expense management software called Fyle.

Nowadays, after employees make business purchases online or use their corporate credit cards, they receive all the bills and invoices in their inbox. Using the same OCR technology, Fyle makes it extremely easy for employees to report expenses from their inbox.

Fyle offers email add-ons for both Gmail and Outlook users for easy expense reporting. After installing the email add-ons, the employees can submit expense reports right from their mailbox by clicking on the Fyle button. The app scans the e-receipt and automatically fills the expense report form for the employee.

Digitizing the entire expense reporting process also means Finance teams can access and store all the expense receipts, and employee expense reports in one place. This reduces the need to manually copy and paste expense details into a spreadsheet.

By using an expense management to report expenses, the Finance team can:

- Ensure proper documentation of expense data

- Encourage faster and accurate expense reporting

- Reduce manual data-entry work and errors

- Eliminate the problem of missing or unreported expense details

- Save both employees and Finance teams time and efforts

- By enforcing real-time policy checks

Manually checking for policy violations can take up a lot of the Finance team’s time. Additionally, the Finance team can easily overlook duplicate or false claims due to the manual verification of expense reports.

While missing a single error can cause an insignificant difference, the same cannot be the case for multiple violations. Having several duplicate claims, overstating expenses, and missing reports can contribute to financial leaks in the system. This can prove detrimental to the financial health of your business.

A robust policy check engine can help tackle this problem. By using an expense management software, the Finance team can configure their travel and expense policy into the software. They can also create and enforce regulations based on different types of employees and business expenses.

Through an expense management software, the Finance team can feed their company policies, and enforce it as well. Thus, making it more effective. For example, whenever employees try to file an expense outside the policy, the software can automatically flag the violation. The employees can then go on to resolve the error.

For finance teams auto-flagging and resolving data errors in real-time translates into:

- Error-free business expense reports

- Save time skimming through reports for policy violations

- Increased in employee compliance

Along with real-time policy violation detection, the Finance team can also set up auto-reminders for employees to submit expense reports. With the help of the feature, the Finance team can ensure timely reporting and eliminate missing reports.

- By offering data analytic insights

Accounting and finance tasks are heavily information related. While it is beneficial to have a large set of data to compare and assess, manually analyzing massive volumes of data can be overwhelming.

But thanks to the era of big data and AI, more data means more accurate predictions!

In an expense management software, the Finance team can collate and store data in a central database. The software then goes through all the expenses transactions, statements, and reports to find spending patterns and trends. After analyzing patterns, the software gathers all the data and presents it with data visualization. This can help the Finance team visualize and digest massive data without feeling overwhelmed.

The software identifies, for example, the areas or the department where most expenses occur. Using these insights, companies can determine their present financial standing and predict potential financial patterns. This will empower the Finance team to forecast potential threats or risks. The team can then come up with strategic plans to reduce costs and achieve business goals.

The bottom line

An organization’s business expense data can reveal a lot about a company’s current and future financial standings. The Finance team can gain helpful insights from all this data. But even if there is data to dig into, if it’s not accurate and reliable, it can lead to misinformation.

A Finance team opting for a modern AI-powered expense management software can easily leverage their expense data findings to achieve their goals. It can help them mend a broken expense reporting process and receive a clean set of expense data to work with.

Fyle is an expense management software that comes with data visualization that helps the Finance team understand spending patterns and trends without having to go through a huge volume of data. This helps businesses to always stay on top of things when it comes to expense reporting and expense management.