The European Union has increasingly become a source of regulatory clarity for the crypto ecosystem. The unified legal MiCA framework establishes a means that players in the crypto space can get approval by the EU to operate throughout the Union.

For more clarity, MiCA sets out the rules not just for crypto companies but also for the regulators that supervise them. This is especially relevant for U.S. companies operating in a regulatory gray area.

The new approach yields results: in the first quarter of 2025, Europe saw volumes of crypto transactions swell by 70%, and France was particularly impressive at +175%.

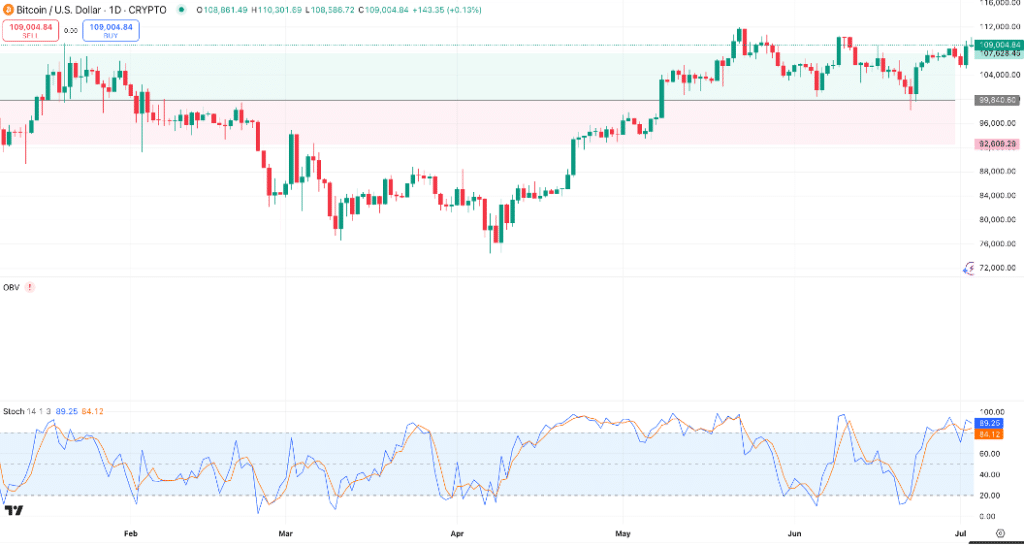

Major platforms like OKX, Bybit, Crypto.com, Coinbase, and Gemini have already obtained their MiCA registration, highlighting a swell of confidence among industry titans in the European model, at a time when the Bitcoin price is consistently above $105,000.

GENIUS Act: American rigor, but at what cost?

Across the Atlantic, the situation is also changing, yet very differently. The GENIUS Act — the Guidelines for Enhanced National Integration of US-Stablecoins — was adopted by the U.S. Senate on June 17, 2025. It establishes a series of regulations that are very strict and cautious in their approach to stablecoins.

The demands are as follows:

- Liquid assets must be 1:1 pegged to the U.S. dollar or Treasury bills

- Compulsory monthly inspections

- Compensating stablecoin holders

The goal is to put financial regulators at ease and maintain the dollar’s dominance. But this might become counterproductive. Quite a few people out there think that such strict regulations could stifle innovation and drive some companies to seek refuge… in Europe.

Europe now needs to transform the try into an apparent success.

Considering how critical the targeted market is, MiCA seems to be a short-term winning bet — it satisfies investors, draws in businesses, and establishes Europe as a go-to jurisdiction for crypto-assets. Even forex indicators, such as fluctuations in the Pound Dollar rate, are beginning to show signs of investor confidence shifting toward Europe. But this lead won’t be sustainable unless it is accompanied by prompt, smooth, and proactive implementation.

To achieve that, the European Union will need to:

- Speed up the licensing process

- Ensure consistent enforcement across countries

- Avoid administrative burdens that could kill momentum

If all this is done and maintained, MiCA will have an even larger edge over the GENIUS Act. The difference is already in the EU’s favor, as seen in the following comparative table.

| Criteria | European Union (MiCA) | United States (GENIUS Act) |

| Regulatory framework | Unified | Fragmented |

| Impact on volumes | High growth | Moderate growth |

| Appeal for exchanges | Strong due to unique license, quick expansion | Average due to strong regulatory constraints |

| Stablecoins | Integrated into MiCA | Strictly regulated, enhanced surveillance |

| Risks | Long-term rigidity if not adapted | Discourages foreign actors |

The means to attract talent, capital, and crypto technology are at Europe’s disposal. It has a clear and operational framework. The United States, on the other hand, is having a not-so-easy time reconciling protection of the dollar with an openness to meaningful innovations.

Companies in the sector view regulation not as a hindrance but as a strategic lever. In a world where digital finance relies on trust, it seems that having clear regulations is a decisive competitive advantage.