In the dynamic world of the semiconductor industry, where competition is measured in nanometers and percentages of usable chips, an event has occurred that could shake up the market and potentially bring some of these companies along as the market movers, while others may happen to be the market losers.

This may be due to Google’s decision to transfer the contract to produce its flagship Tensor G5 processor for Pixel 10 smartphones to TSMC, leaving its long-time partner, Samsung Electronics, on the sidelines. These two companies are expected to be in turbulence for the upcoming weeks.

This move indeed is a shock to the leadership in Suwon and highlighted the deep problems of the South Korean giant in the critically important contract manufacturing segment.

Although Samsung announced and started production on the 3nm process technology earlier than TSMC, the company still faces a catastrophically low yield of usable chips, about 50%. Half of the chips produced are defective, dramatically increasing costs and reducing profitability.

Taiwan’s leader in contract manufacturing has demonstrated outstanding stability. The rejection rate in their 3nm process technology does not exceed 10%. This 40 percentage point difference is not just a number — it’s a fundamental advantage in productivity, cost, and supply reliability. It’s also one of the reasons why TSMC is frequently mentioned among the highest dividend stocks, attracting investors who value both technological leadership and consistent shareholder returns.

TSMC’s superiority and reputation as a reliable partner have become key factors for Google. The company has entrusted TSMC with producing Tensor G5 for Pixel 10 (expected in August 2025) and chips for several subsequent generations, signalling a long-term shift in supply strategy.

Google’s decision was not just a loss of a large order for Samsung, but a wake-up call. The company’s management is seriously concerned and taking emergency measures such as in-depth audits, restructuring, and accelerating R&D.

In addition to the apparent problems with the quality and output of 3nm products, Google’s decision was influenced by the fact that TSMC-made chips often show a small but significant advantage in speed and power consumption compared to Samsung counterparts at similar manufacturing scales.

Moreover, TSMC has a much broader and more diversified customer base such as Apple, AMD, Nvidia, Qualcomm, and others, which makes it possible to optimize factory utilization and distribute R&D costs. Samsung has historically been strong in manufacturing for its own needs, and its contract division (Samsung Foundry) has failed to attract an equally vast pool of leading fabless companies.

The loss of such a strategic and prestigious client as Google causes severe damage to Samsung Foundry’s image as an advanced manufacturer. This may scare off other potential customers and force existing ones to renegotiate their contracts. And the low yield of functional processors and the loss of large contracts directly affect the profitability and revenue of the division.

However, Samsung has retained the contract to manufacture modems for the Pixel 10. This indicates that the break is incomplete and cooperation in other areas continues. But they are not flagship SoCs that determine device performance.

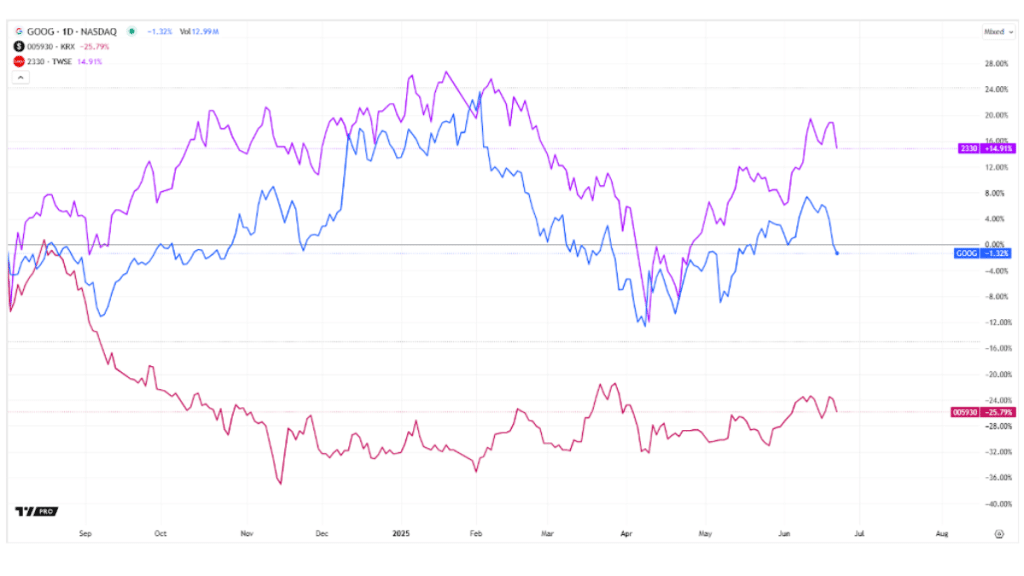

The chain of negative news for Samsung and positive news for TSMC, as key players in the technology sector, may finally give momentum to the market. The growing volatility in this highly capitalized and sensitive segment can shake up the market, especially if investors reconsider their expectations about the future earnings of these titans.

Samsung is at a crossroads, and its next steps in contract manufacturing will be critical for its future and the balance of power in the semiconductor industry. A technological lag can be very costly in a market measured in billions of dollars.